- "Fill the Gap" with the CMT

- Analyzing India

- Art's Charts

- ChartWatchers

- Dancing with the Trend

- DecisionPoint

- Don't Ignore This Chart!

- GoNoGo Charts

- Mish's Market Minute

- RRG Charts

- Stock Talk with Joe Rabil

- StockCharts In Focus

- The Final Bar

- The MEM Edge

- The Mindful Investor

- The Traders Journal

- Top Advisors Corner

- Trading Places with Tom Bowley

- Wyckoff Power Charting

- MEMBERS-ONLY BLOGS

- John Murphy's Market Message

- Martin Pring's Market Roundup

- Larry Williams Focus On Stocks

Archived News

- MEMBERS ONLY

- John Murphy's Market Message

- Martin Pring's Market Roundup

- Larry Williams Focus On Stocks

- "Fill the Gap" with the CMT

- Analyzing India

- Art's Charts

- ChartWatchers

- Dancing with the Trend

- DecisionPoint

- Don't Ignore This Chart!

- GoNoGo Charts

- Mish's Market Minute

- RRG Charts

- Stock Talk with Joe Rabil

- StockCharts In Focus

- The Final Bar

- The MEM Edge

- The Mindful Investor

- The Traders Journal

- Top Advisors Corner

- Trading Places with Tom Bowley

- Wyckoff Power Charting

Popular Articles

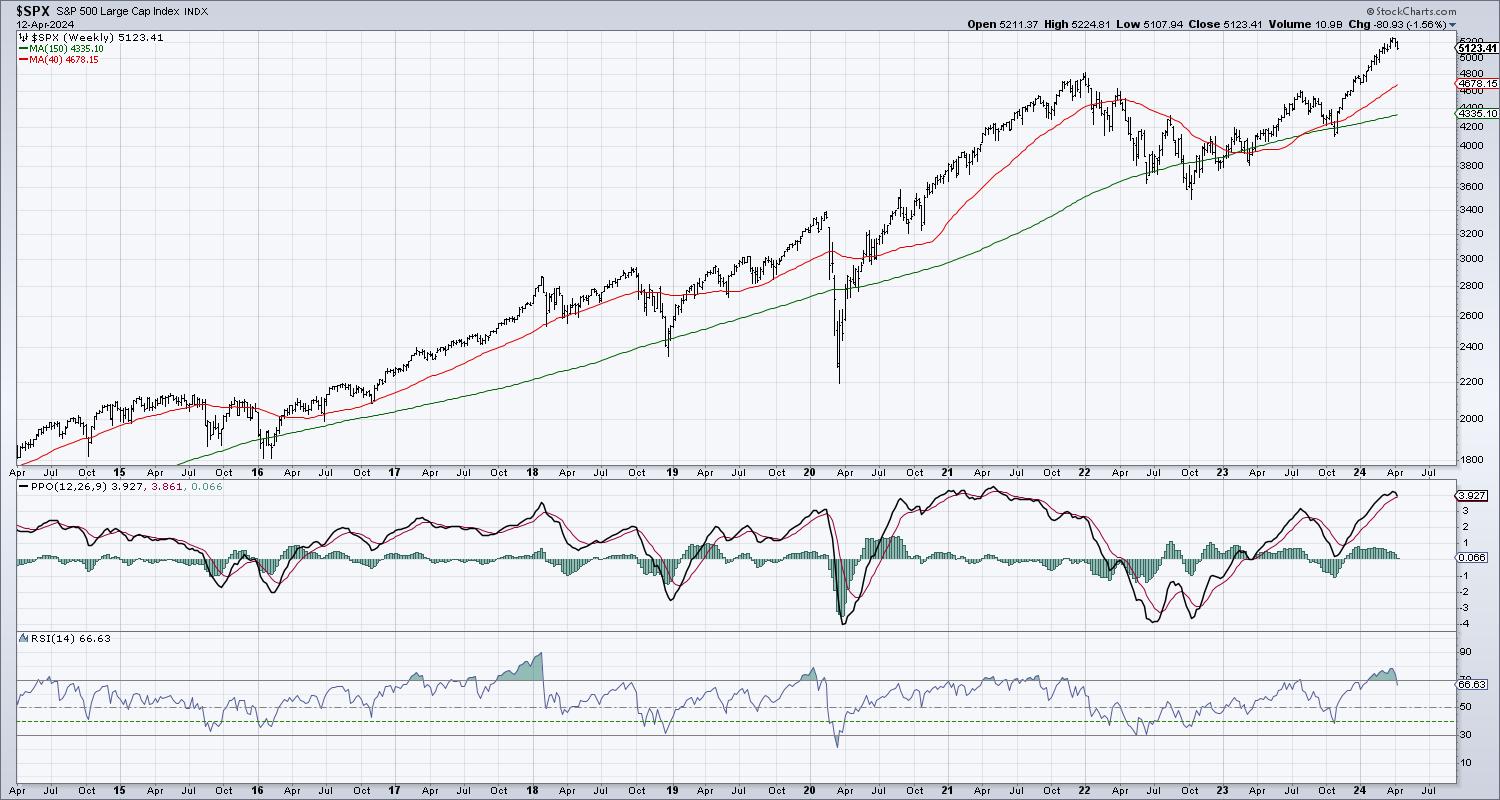

S&P 500 Flashes Major Topping Signals

David Keller

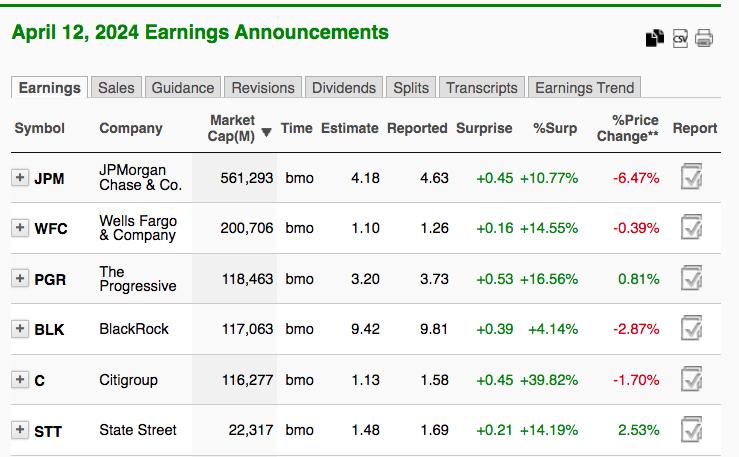

Are The Financials Sending Us A Major Warning Signal?

Tom Bowley

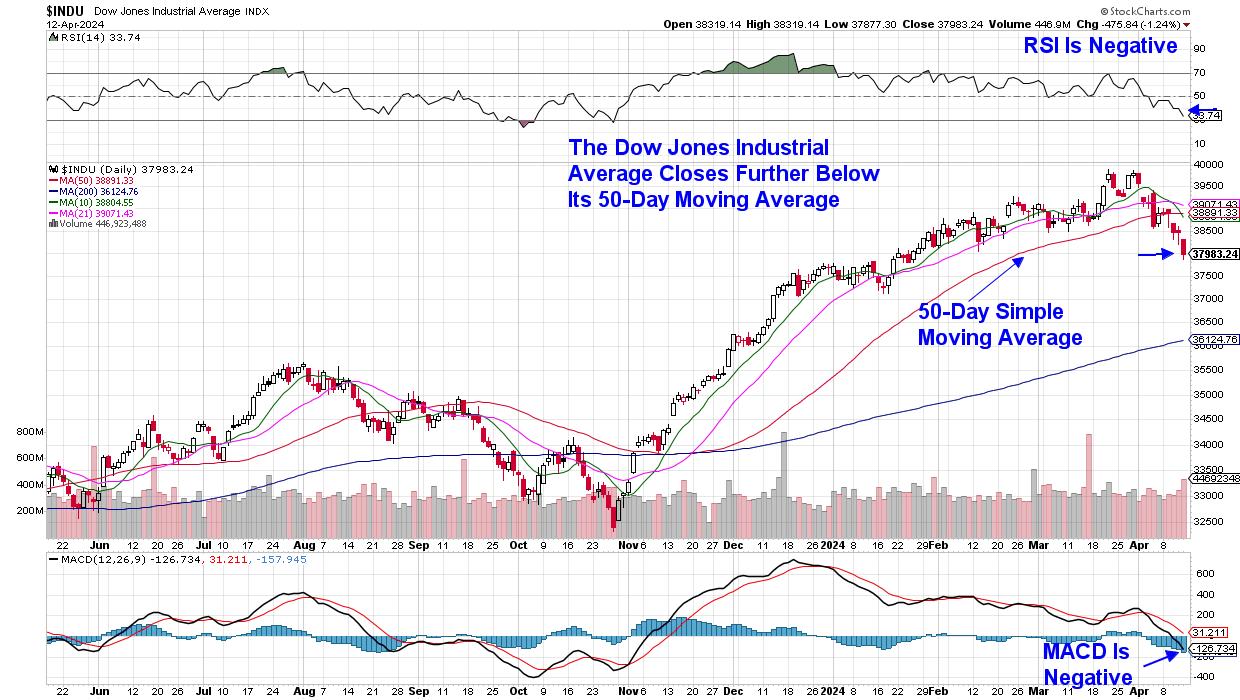

Stock Market Indexes Plunge After Hitting Resistance -- Support Levels You Need to Watch

Jayanthi Gopalakrishnan

Keeping Up With The Jones - How Weakness in This Index May Foretell a Broader Market Correction

Mary Ellen McGonagle

Using Outsized Moves to Identify Trend Reversals - Checking in on Housing and Semis

Arthur Hill

From Relic To Reckoning: Can Gold Surge To $3,000?

Karl Montevirgen

Get expert technical commentary delivered straight to your inbox! Sign up for our FREE weekly ChartWatchers Newsletter. Learn More

Featured Authors

Top Advisors Corner

Featuring a diverse collection of books, DVDs and more, The StockCharts Store has everything you need to learn more about financial charting, improve your trading systems and become a better investor.

Public ChartList Leaders

StockCharts Members unlock complete access to the Stocks & Commodities Magazine archives. Read the latest articles or browse past editions.