This is the fifth article in a series about a 1700 Kilometre (over 1000 miles) road trip that I did two weeks ago. You can follow these links to the first four articles.

Canadian Transportation Companies Start My Tour

Canadian Forestry Companies Under Review

Canadian Pipeline Companies Under The Microscope

Canadian Pipeline Companies Under The Microscope (Part 2)

On my road trip through the mountains and into the grain growing region, a massive transition from mining and forestry into grain and livestock takes place. We also travelled through Jasper National Park. Caribou are not found as far south as Calgary, but this bull Caribou was just east of the Jasper townsite.

The horses and cattle meandering through pastures filled with clover, fescue, and alfalfa are fun to watch with their slow walk while they eat. We also saw bison paddocks and elk farms that were more exotic, and lots of traditional Angus and Hereford cattle ranches. It is hard to beat the beautiful crops of wheat, barley, and rye swaying in the wind. We spent an entire evening driving around checking different crops. A farmers view of what is going on is as close to the industry as we can get. With the swelling crops, a farmer has to balance how long past harvest he can hold the grain and still manage cash flow. The grain elevator system has changed immensely over the years and the wood elevators of days gone by are long gone. Now they are massive concrete silo terminals that can handle 110 car trains on a siding. Making sure these terminals have room for the farmer to haul into is another part of the mix. They may have to wait until a train has left to clear room for new products to arrive.

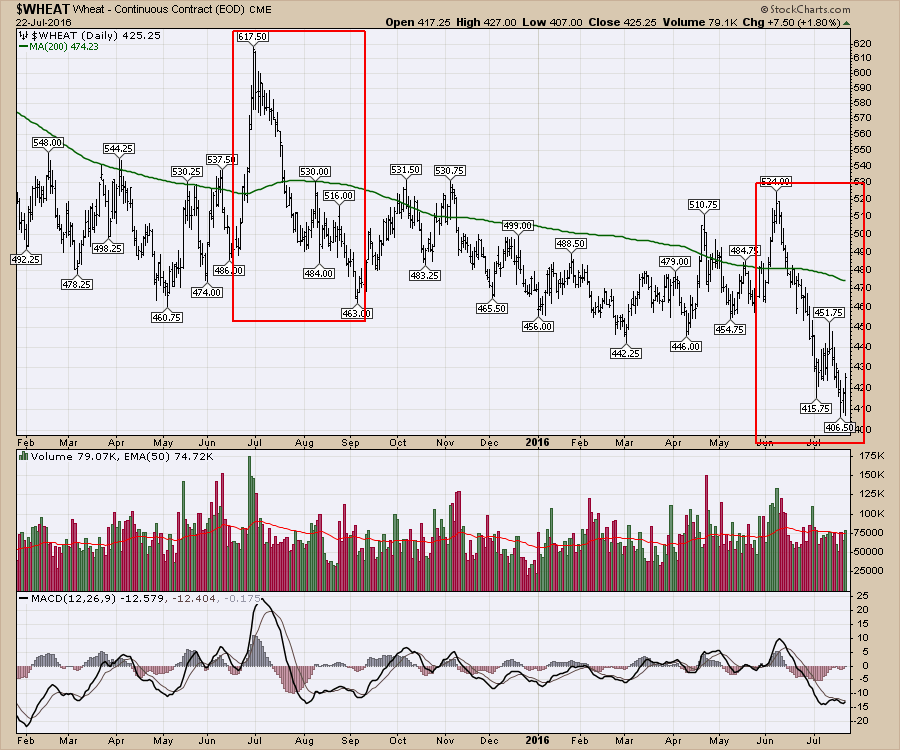

In discussions about grain marketing, seasonal timing, as well as volumes and cash flow all come into the mix for selling grain. The chart of $WHEAT is particularly weak this year, probably due in part to the beautiful crops coming in. Lots of grain is readily available, making this a hard year to sell into.

In discussions about grain marketing, seasonal timing, as well as volumes and cash flow all come into the mix for selling grain. The chart of $WHEAT is particularly weak this year, probably due in part to the beautiful crops coming in. Lots of grain is readily available, making this a hard year to sell into.

Getting into some of the industry charts, Canada's largest agricultural company would be Agrium (AGU.TO, AGU). They have a major presence on the prairies including many Viterra terminals like the one shown above, and another division called Crop Production Services which distributes fertilizers and ag-related products. The chart of Agrium is timely. The SCTR is stuck below 30. As many readers will know, I like when the behaviour of the stock starts to change. The SCTR is one of the easiest ways to see that. When the SCTR rallies out of this beaten down range, it is usually a good clue towards a trend change. The price action itself has finally moved above the 40 WMA for the first time in 8 months. It closed above for 2 weeks in a row, so this is an important time to watch. The red trend line also shows Agrium at resistance but it just made new 5-month highs. The MACD has just gone positive. This is an important place for the investors. If momentum on the MACD goes back negative, this is a good stock to avoid. If it can break through resistance on the price, the SCTR will start to perk up and the MACD will move higher with positive momentum. That would make this $127 area a good entry point.

Getting into some of the industry charts, Canada's largest agricultural company would be Agrium (AGU.TO, AGU). They have a major presence on the prairies including many Viterra terminals like the one shown above, and another division called Crop Production Services which distributes fertilizers and ag-related products. The chart of Agrium is timely. The SCTR is stuck below 30. As many readers will know, I like when the behaviour of the stock starts to change. The SCTR is one of the easiest ways to see that. When the SCTR rallies out of this beaten down range, it is usually a good clue towards a trend change. The price action itself has finally moved above the 40 WMA for the first time in 8 months. It closed above for 2 weeks in a row, so this is an important time to watch. The red trend line also shows Agrium at resistance but it just made new 5-month highs. The MACD has just gone positive. This is an important place for the investors. If momentum on the MACD goes back negative, this is a good stock to avoid. If it can break through resistance on the price, the SCTR will start to perk up and the MACD will move higher with positive momentum. That would make this $127 area a good entry point.

Here is AGT Food and Ingredients (AGT.TO). This stock is small with a market cap under $1B. It is trying to hold onto a 4-year trend. Large areas of peas are starting to be planted as Canada has become one of the top exporters of pulse crops. AGT.TO plays a role in the pulse crops area of the Ag market.

Potash (POT.TO, POT) is considered an important component for the Ag industry. My understanding is that potash is not used in a big way in Canada, but other countries tend to use it more. For Potash Corporation, the chart looks grim. The SCTR has been basing for a year. A break above the red line could suggest something is changing. Until there is a change in the trend, this looks like a good stock to avoid.

Potash (POT.TO, POT) is considered an important component for the Ag industry. My understanding is that potash is not used in a big way in Canada, but other countries tend to use it more. For Potash Corporation, the chart looks grim. The SCTR has been basing for a year. A break above the red line could suggest something is changing. Until there is a change in the trend, this looks like a good stock to avoid.

Cargill - privately held, and Archer Daniels Midland (ADM) are the other two elephants in the room regarding grain handling in Canada. ADM is well above its 40 WMA and as long as that stays in place, it is a bullish story. Currently, it is also above the 10 WMA and that is more of a swing trading level. Above the 10 WMA is bullish but the stock is approaching the $44 level that was support for the topping structure in 2014-2015. If this becomes a significant resistance, technically this would be a bad place for the chart to fail. When a retest of the neckline level from below fails, it is usually a sign of significantly lower prices. An example is the October 2015 price action.

Cargill - privately held, and Archer Daniels Midland (ADM) are the other two elephants in the room regarding grain handling in Canada. ADM is well above its 40 WMA and as long as that stays in place, it is a bullish story. Currently, it is also above the 10 WMA and that is more of a swing trading level. Above the 10 WMA is bullish but the stock is approaching the $44 level that was support for the topping structure in 2014-2015. If this becomes a significant resistance, technically this would be a bad place for the chart to fail. When a retest of the neckline level from below fails, it is usually a sign of significantly lower prices. An example is the October 2015 price action.

While all of the commodities are being drawn lower here, the bullish crop forecast is threatening significant lower prices. Canadian National Railway (CNR.TO) noted they were experiencing lower volumes and they are looking forward to moving more grain by rail with the strong crop forecast as crude oil shipping has slowed significantly.

While all of the commodities are being drawn lower here, the bullish crop forecast is threatening significant lower prices. Canadian National Railway (CNR.TO) noted they were experiencing lower volumes and they are looking forward to moving more grain by rail with the strong crop forecast as crude oil shipping has slowed significantly.

I'll be covering off more of these Canadian sectors as we roll through the month and I'll definitely be talking about them on the Canadian Technician Webinar 2016-07-26. In the next few articles, I'll dive into the oil and gas sector along with the services sector. They tend to coexist in Northern BC as well as throughout Alberta. Below, fields of bright yellow canola shine brightly with oilfield locations spread intermittently. It is a peaceful view away from the urban landscapes.

For the Canadian Technician Webinar 2016-07-26, click on the link to register. If not, you can check the webinar archives found here. StockCharts Webinar archives. You can also follow me on twitter @Schnellinvestor and LinkedIn. If you would like to receive the rest of this series in your email, please click on the subscribe button below. This blog is focused on Canadian investing opportunities.

For the Canadian Technician Webinar 2016-07-26, click on the link to register. If not, you can check the webinar archives found here. StockCharts Webinar archives. You can also follow me on twitter @Schnellinvestor and LinkedIn. If you would like to receive the rest of this series in your email, please click on the subscribe button below. This blog is focused on Canadian investing opportunities.

Good trading,

Greg Schnell, CMT, MFTA