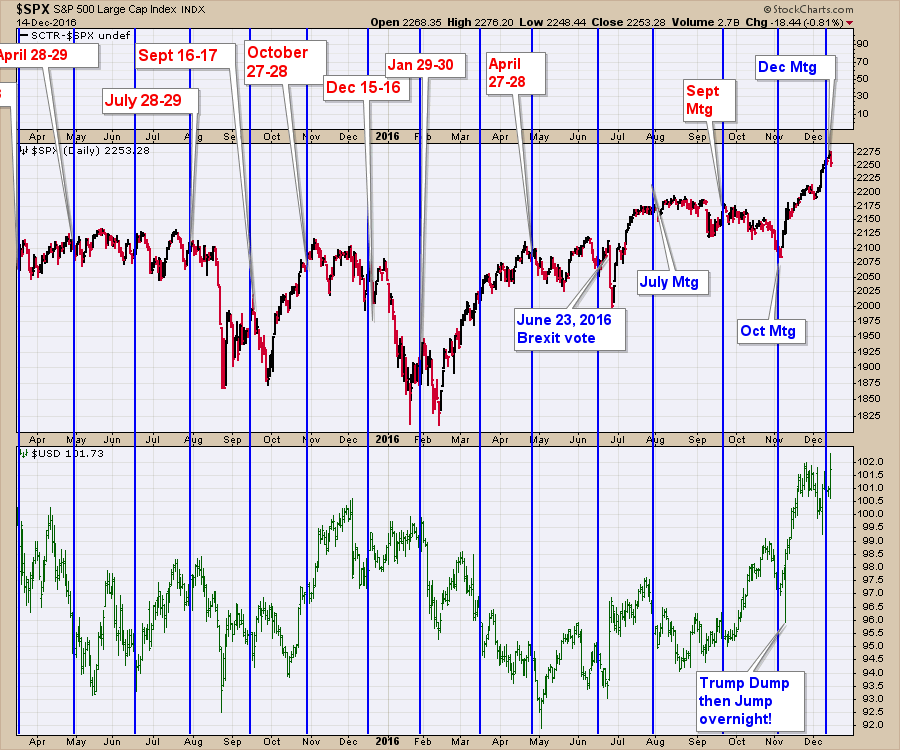

Well, another year of Fed meetings and another December 0.25% rate increase with predictions for a more aggressive pace next year. So in a day where we got what we expected why did the market wobble this time? At the last Fed meeting (October), we got what we expected and it marked the November low in the markets and the US Dollar.

Zooming in on the $TSX and the Canadian Dollar, both got rocked today. Adding on the downward pressure, the price of oil (USO) looks like a failed breakout and now it has broken the uptrend. A double negative? Lastly, Gold (GLD) starting drilling lower after falling below support.

I reviewed Gold multiple times over the last two weeks on the blogs and webinars. Last year, Gold made a final low the day after the Fed meeting, so we continue to watch gold for signs of reversing. It may not come to pass if the US Dollar keeps surging.

I reviewed Gold multiple times over the last two weeks on the blogs and webinars. Last year, Gold made a final low the day after the Fed meeting, so we continue to watch gold for signs of reversing. It may not come to pass if the US Dollar keeps surging.

There has been some inclination towards rotation in the sectors. While it might work out to be nothing, I spent most of the webinar on December 13th, discussing the early signs of some potential changes.

The Canadian Technician LIVE! with Greg Schnell - 2016-12-13 17:00 from StockCharts.com on Vimeo.

There are so many bullish signs in the market right here, its hard to believe the market could change trend now. However, there can be a lot of changes to the market complexion if oil continues to break down, or the surging US dollar starts hurting international companies, or commodities struggle with $USD headwinds to name just a few scenarios.

I walked through a lot of charts on the Tuesday webinar and tried to outline areas of opportunity. Hopefully you'll find some ideas to follow there.

I think we need to stay tuned for more changes! I like to watch what happens the day after the Fed. Reversals tomorrow would trap a lot of people on the wrong side after such a big impulsive move through various trendlines on Fed day on the different charts. I will try to cover some of that off on the Commodities Countdown Webinar 2016-12-15. Click to register.

Good trading,

Greg Schnell, CMT, MFTA.