ChartWatchers September 22, 2007 at 10:06 PM

It's been a very long time, but we can now unequivocably say that we have an accommodating Fed. The lowering of interest rates was the next piece of our bullish jigsaw that fit perfectly. It's all coming together. The bond market knew it was coming... Read More

ChartWatchers September 22, 2007 at 10:05 PM

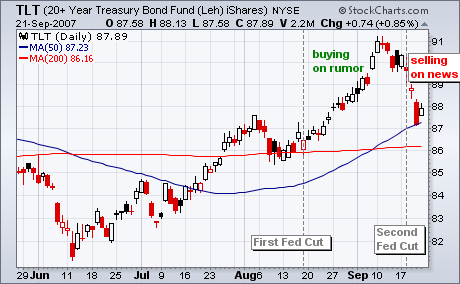

Buy-on-Rumor and Sell-on-News is a classic Wall Street axiom. In the internet heyday, Yahoo! would surge into its earnings announcement and then correct with a pullback near the actual announcement... Read More

ChartWatchers September 22, 2007 at 10:04 PM

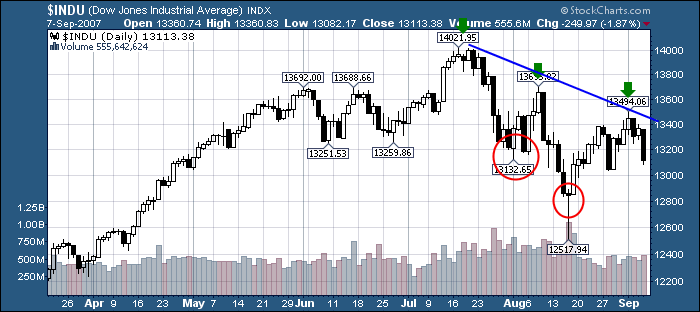

Ever since the market hit its correction lows in August I have written three articles, each emphasizing that the odds favored a retest of those lows (see Chart Spotlight on our website)... Read More

ChartWatchers September 22, 2007 at 10:03 PM

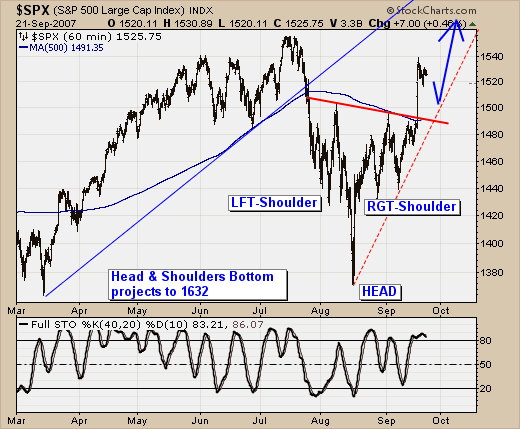

The "surge" of the past month in the S&P 500 is nothing short of astounding; and given the technicals involved – we believe prices are set to continue moving higher with a projection to 1630 into the October-December time frame. This represents a +6... Read More

ChartWatchers September 22, 2007 at 10:01 PM

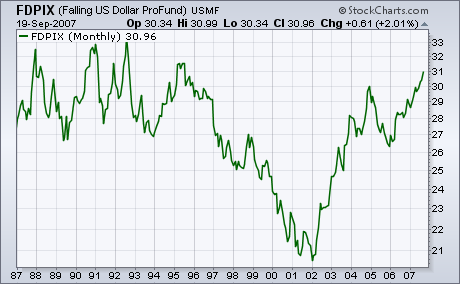

I first wrote about this inverse dollar fund in April 2006 and again on July 13 of this year. The ProFund Falling US Dollar Fund (FDPIX) is a mutual fund designed to trade in the opposite direction of the US Dollar Index... Read More

ChartWatchers September 22, 2007 at 10:00 PM

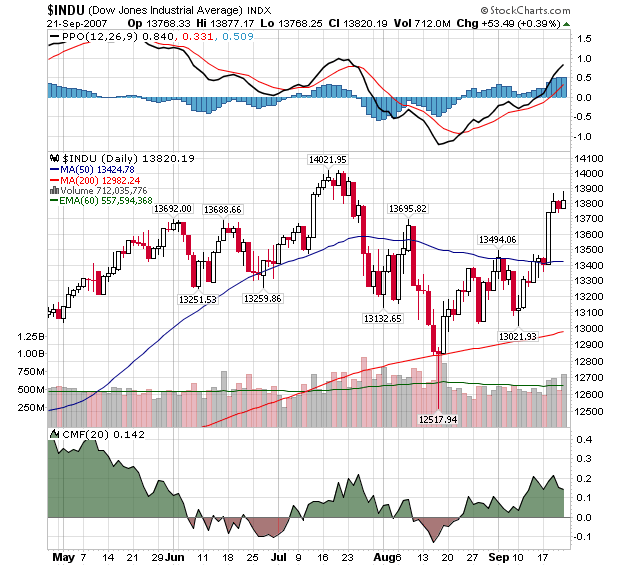

The Fed's surprising move last Tuesday did wonders for the major averages and "wrecked" many technical forecasts in the process (oh well)... Read More

ChartWatchers September 07, 2007 at 10:06 PM

The jobs report sent a jolt to the stock market on Friday. We believe it'll be a temporary jolt, but a jolt nonetheless. That data gave the Fed all the ammunition it needs to do what the market has been expecting for weeks - to cut the fed funds rate... Read More

ChartWatchers September 07, 2007 at 10:05 PM

The Finance SPDR (XLF) and Consumer Discretionary SPDR (XLY) formed large double tops this year, and both broke support in late July to confirm these bearish reversal patterns... Read More

ChartWatchers September 07, 2007 at 10:04 PM

It is well known that October is the cruelest month on average, but sometimes September beats October to the punch. This may be one of those times... Read More

ChartWatchers September 07, 2007 at 10:03 PM

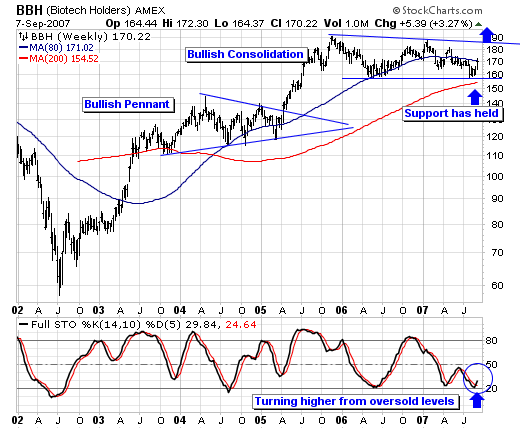

Although last week's broader market was under pressure, the long forgotten Biotech HOLDRs (BBH) showed surprising resilience, and, in fact, is on the cusp of a major breakout. If you'll recall, BBH has underperformed badly in the past, even while posting very good earnings... Read More

ChartWatchers September 07, 2007 at 10:01 PM

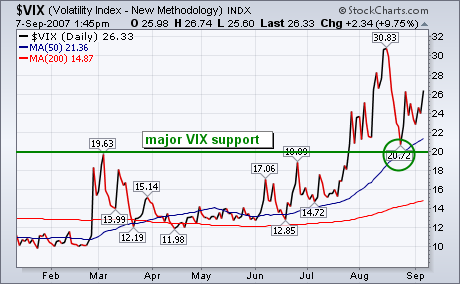

Earlier in the week I heard a TV commentator (masquerading as an analyst) give his interpretation of the CBOE Volatility (VIX) Index. His conclusion of course was bullish. He correctly pointed out that peaks in the VIX usually coincide with market bottoms... Read More

ChartWatchers September 07, 2007 at 10:00 PM

"The trend is your friend" or, in this case, the market's enemy. You may have noticed lots of vacillating in the traditional financial press this past week - gloom and doom after the market closes lower, supreme optimism the very next day when the market moves higher... Read More