ChartWatchers October 17, 2010 at 02:18 AM

Previous messages showed the upside breakout in the Dow Transports (over their summer high) which confirmed a previous upside breakout in the Dow Industrials and constituted a Dow Theory buy signal (see circle)... Read More

ChartWatchers October 17, 2010 at 02:11 AM

I spend a great deal of time evaluating the financial sector because I believe it's the most influential group in terms of leading the market. Financials underperformed miserably in 2007 and 2008 and overall market performance followed suit... Read More

ChartWatchers October 17, 2010 at 02:08 AM

A subscriber had some questions about the Percent Buy Index (PBI) versus the Bullish Percent Index (BPI). The PBI is my creation, and it tracks the percentage of Price Momentum Model (PMM) buy signals for the components in a given index... Read More

ChartWatchers October 16, 2010 at 03:48 PM

Hello Fellow ChartWatchers! Today I want to answer a question that we get frequently - "Where do I start? This is all so overwhelming!" The answer is, you start with John Murphy's 10 Laws of Technical Trading... Read More

ChartWatchers October 16, 2010 at 06:21 AM

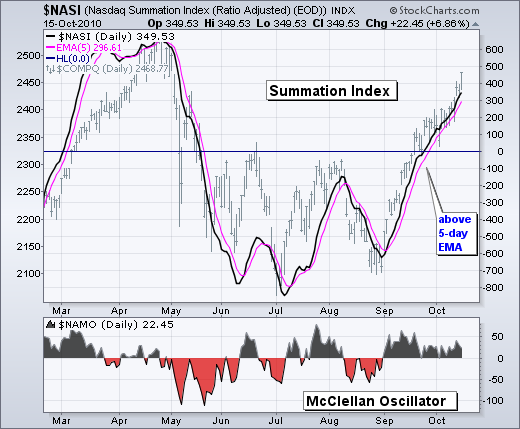

Even though stocks are overextended after a massive seven week run, we have yet to seen any evidence of weakness that would signal the start of a correction or pullback... Read More

ChartWatchers October 02, 2010 at 09:56 PM

Hello Fellow ChartWatchers! (Here's an article I wrote back in 2007. We've gotten several questions about this topic recently, so I thought I'd re-print this now. Enjoy! - Chip) Mary W... Read More

ChartWatchers October 02, 2010 at 08:33 PM

Great question. There are as many arguments saying "no" as there are those saying "yes". Who do you believe? In August, our major indices were tumbling and it seemed like every media outlet was touting our doom and gloom... Read More

ChartWatchers October 02, 2010 at 08:18 PM

The S&P 500 rally off the late-August lows continues apace, although it would appear that it is stalling and a correction at a minimum is warranted... Read More

ChartWatchers October 02, 2010 at 07:51 PM

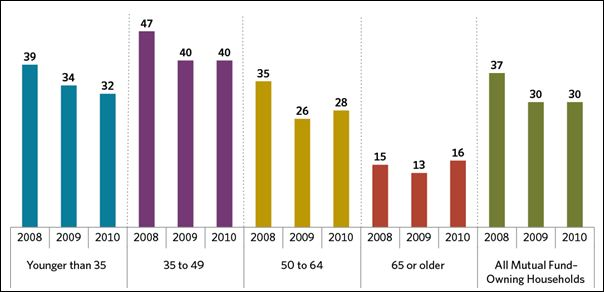

According to the Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey, shareholders' willingness to take "substantial or above average risk" has not recovered since the beginning of the financial crisis started in 2008... Read More

ChartWatchers October 01, 2010 at 10:20 PM

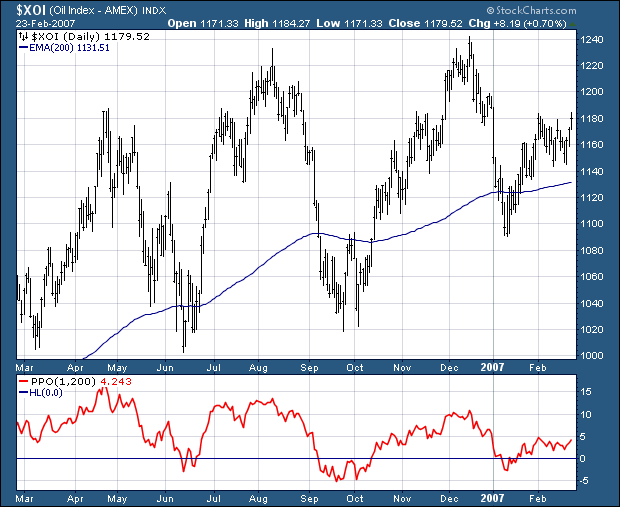

Oil finally started making up for lost time. Despite strength in stocks and weakness in the Dollar throughout September, oil remained below its mid September high the latter part of the month. Broken support around 34 turned into resistance and was holding... Read More