ChartWatchers January 21, 2017 at 05:06 PM

The pullback in Treasury yields (coinciding with an oversold bounce in Treasury prices) may have run its course. Chart 1 shows the 10-Year Treasury Yield ($TNX) bouncing sharply off its 50-day moving average. The two momentum indicators above Chart 1 are also supportive... Read More

ChartWatchers January 21, 2017 at 02:31 PM

There haven't been too many areas of the market that have performed worse than retail stocks over the past month... Read More

ChartWatchers January 21, 2017 at 06:41 AM

One would normally not consider Facebook, Alphabet, Apple, Amazon and Microsoft boring. Well, maybe Microsoft. All joking aside, these tech titans are the biggest stocks in the Nasdaq 100 ETF (QQQ) and they account for around 40% of the ETF... Read More

ChartWatchers January 20, 2017 at 11:41 PM

Cruise ships seem to be getting more elaborate every year. From water slides high up over the ocean, to real grass top decks and stunning restaurants throughout, the industry is growing in diversity and customer experiences... Read More

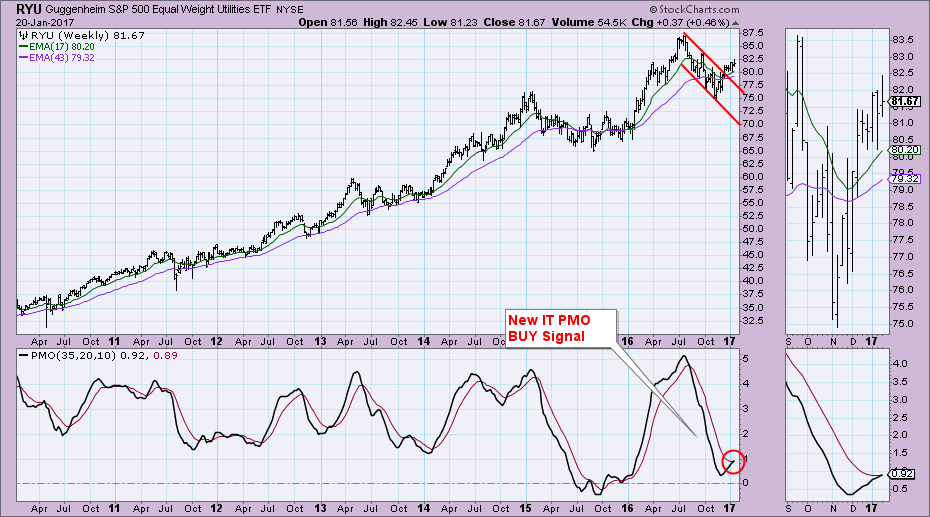

ChartWatchers January 20, 2017 at 09:00 PM

On Friday, I received a StockCharts Technical Alert in my email inbox letting me know that the Equal-Weight Utilities ETF (RYU) had triggered a new Intermediate-Term Price Momentum Oscillator (PMO) BUY signal. I immediately had to check out the weekly chart... Read More

ChartWatchers January 20, 2017 at 04:31 PM

Earnings Season is now in high gear with thousands of companies getting ready to report their numbers over the next several weeks... Read More

ChartWatchers January 07, 2017 at 03:13 PM

Let's get this out of the way first. If you've been watching business TV, all they've been talking about is the Dow nearing the 20,000 level. Much to their dismay, it came close on Friday but couldn't make it. The Dow touched 19999.63 before backing off... Read More

ChartWatchers January 07, 2017 at 03:06 PM

No one can argue with the fact that the market has been fascinating to watch since the election with all of the major indexes substantially higher since the most recent bottom on November 4... Read More

ChartWatchers January 07, 2017 at 01:24 PM

I've been writing relentlessly about the relative strength in energy shares (XLE) over the past several months and here I go again. Go ahead and talk about too much supply. Hang onto the weakening demand argument if you'd like... Read More

ChartWatchers January 07, 2017 at 01:08 PM

Gold traded fabulously last year. Actually Gold surged from January to March then went sideways. Well Gold has started to outperform the $SPX but everything else looks dismal. The SCTR is stuck at 2% even after Gold surged... Read More

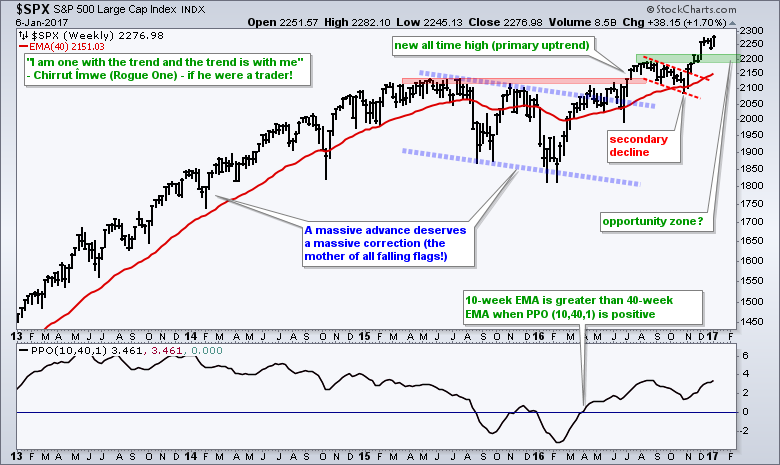

ChartWatchers January 07, 2017 at 04:34 AM

I recently saw the new Star Wars movie, Rogue One, and found a way to tie technical analysis to one of the more interesting characters. This happens all of the time because technical analysis is so ingrained in my membrane... Read More

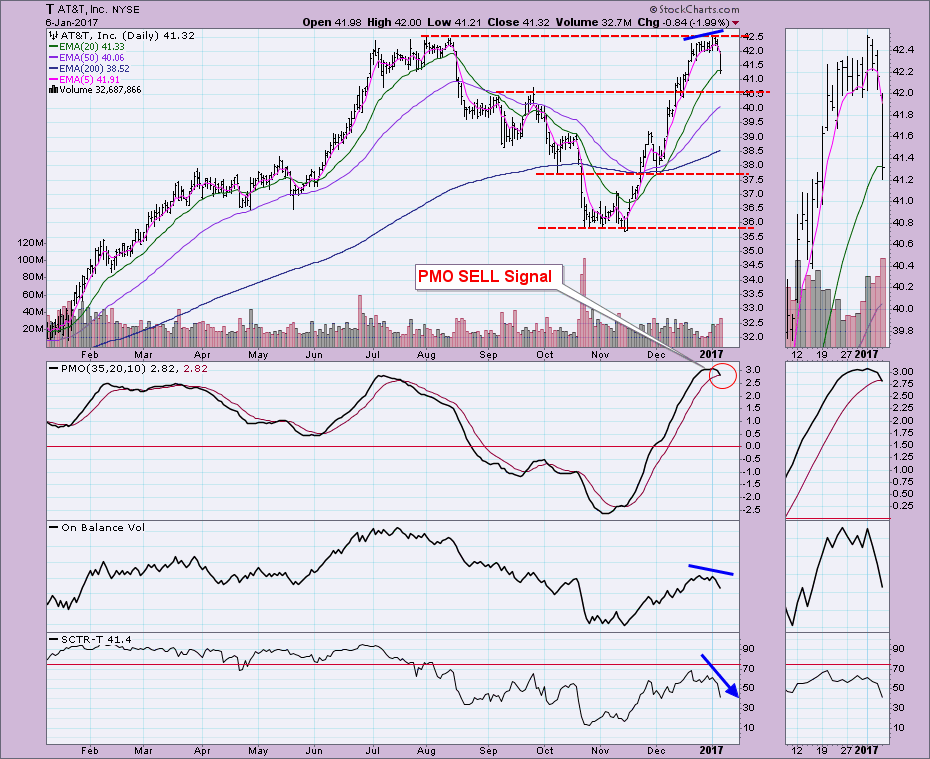

ChartWatchers January 06, 2017 at 10:26 PM

A regular DecisionPoint webinar viewer and reader emailed me and suggested I take a look at AT&T because as he stated, "ouch". It was definitely a rough day for AT&T and what happened today has some very interesting implications. Price dropped almost 2% today... Read More