Well, the market participants will be a little unnerved as they chew on their scones and clotted cream this weekend.

On Thursday's webinar, I connected the dots across currencies, global markets, and commodities going into the vote. There were a tremendous number of charts set up for a major move if the British vote was to remain. Obviously, this was not to be.

The chart list is long.

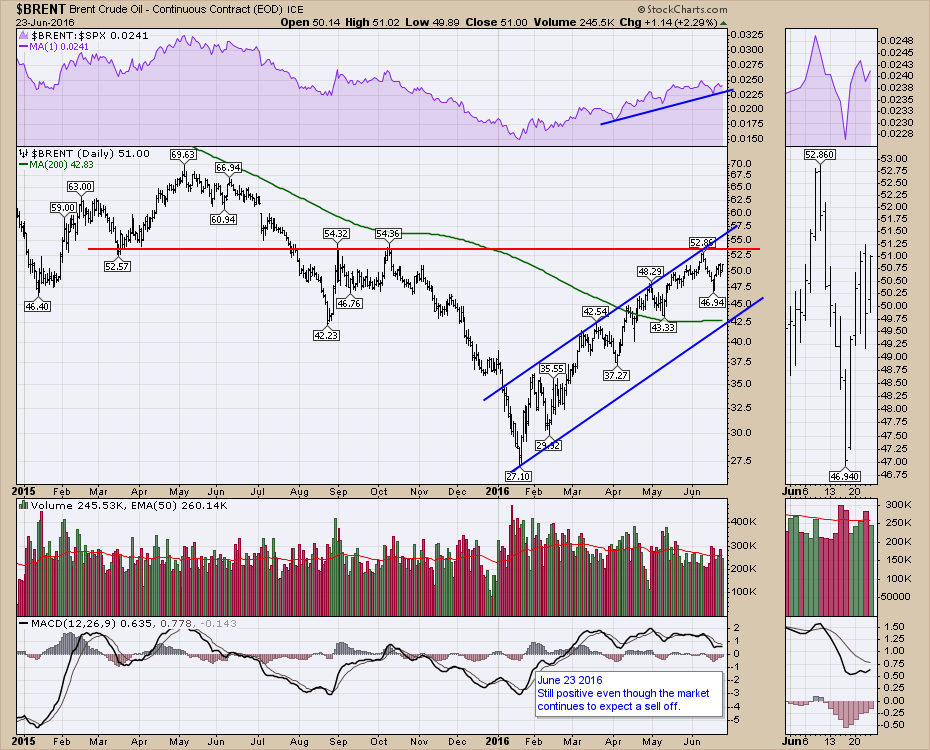

- Commodities - $BRENT, $WTIC, $GOLD, $SILVER

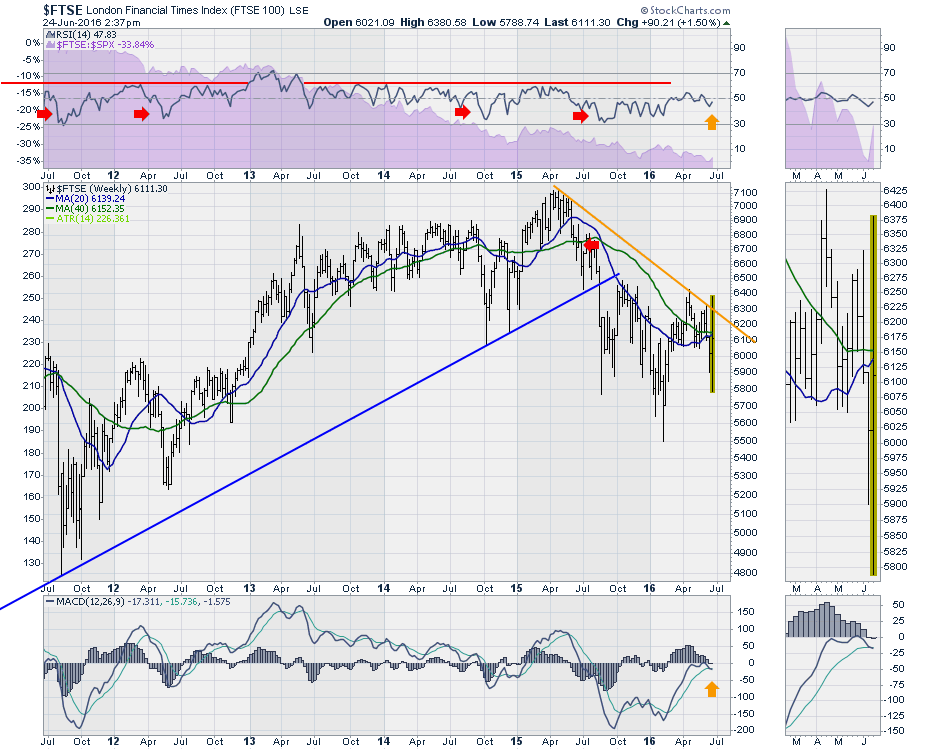

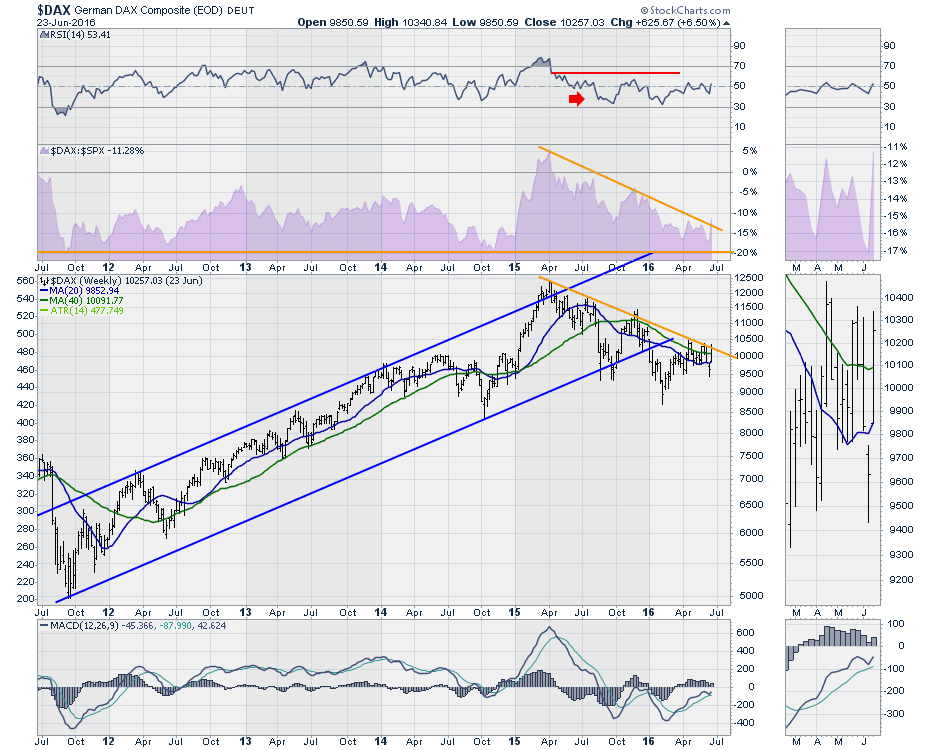

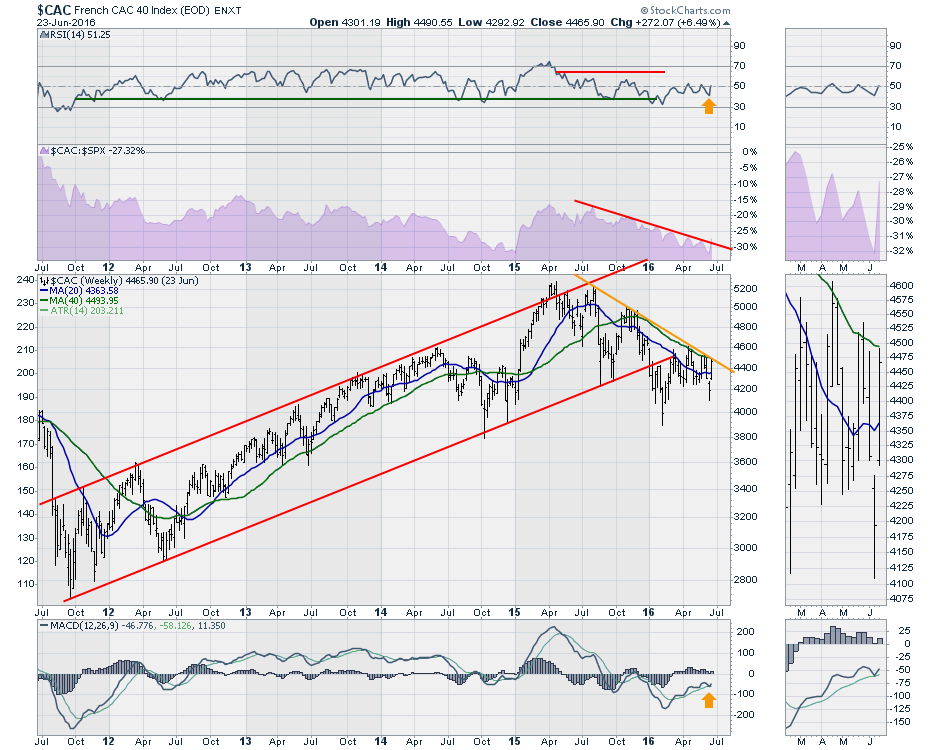

- Markets - $FTSE, $DAX, $CAC, $AORD,$SPX,$TSX

- Currencies - $XJY, $GBP, $XEU, $XAD, $CDW

We were on the watch for combined, supportive moves that would confirm a change in trend. The combined moves are now demonstrating the resistance at the trendlines will hold. I would encourage you to view the webinar to understand how high the correlation was and the dialogue that went with it.

Commodities Countdown LIVE! with Greg Schnell - 2016-06-23 17:00 from StockCharts.com on Vimeo.

$BRENT is the Crude reference price for Europe. Tucked just under the horizontal resistance, this will probably test the lower end of the range.

For North American Crude Oil markets, here is a look at West Texas Crude. $WTIC. This is another chart that was set up against resistance. A test of the 200 DMA is in order now.

For North American Crude Oil markets, here is a look at West Texas Crude. $WTIC. This is another chart that was set up against resistance. A test of the 200 DMA is in order now.

Another commodity under watch through this is Gold. The MACD had given us a sell signal on Thursday and the Relative Strength had been underperforming the $SPX. At the time of writing, Gold was trading at 1340.

$SILVER usually tracks Gold to some extent. $SILVER was set up under resistance.

$SILVER usually tracks Gold to some extent. $SILVER was set up under resistance.

The $FTSE had broken out above the trend on Thursday. We were talking about a 6400 breakout on a Bremain vote on the webinar yesterday. If it failed, that would be just as important. This would be called an outside week!

The German $DAX was poised against resistance as well. A breakout above the trend would confirm a new breakout in Europe. Well, you might need some sauerkraut with this chart. This chart does not reflect Friday's trading.

The German $DAX was poised against resistance as well. A breakout above the trend would confirm a new breakout in Europe. Well, you might need some sauerkraut with this chart. This chart does not reflect Friday's trading.

The French market $CAC will be having a second latte today. Once again, the resistance will hold.

The French market $CAC will be having a second latte today. Once again, the resistance will hold.

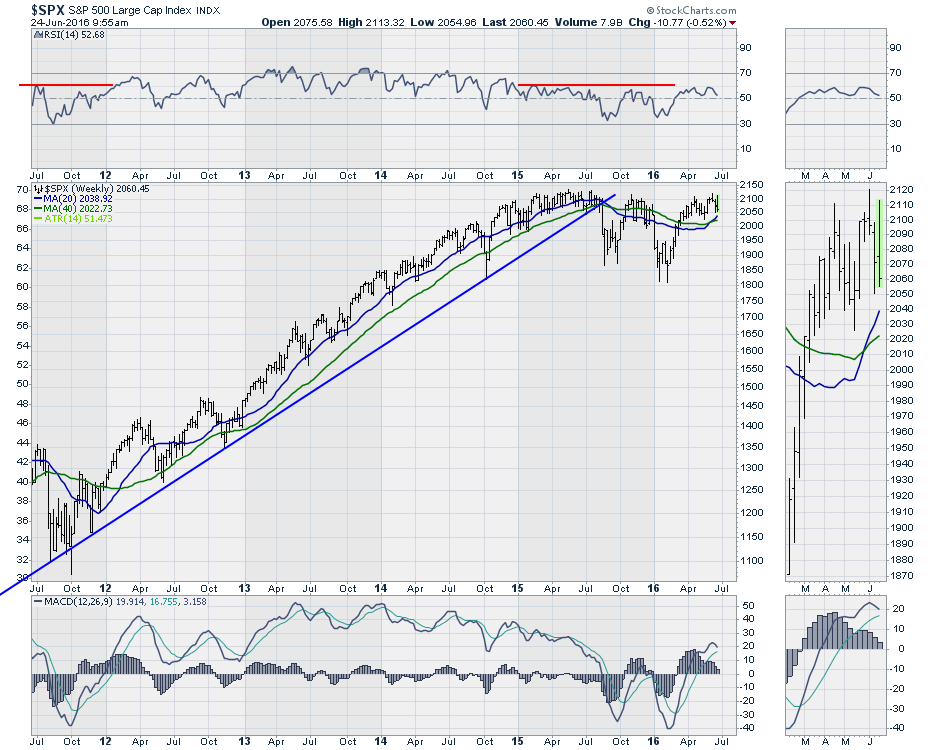

The $SPX was also poised for an upside move. That will have to wait.

The $SPX was also poised for an upside move. That will have to wait.

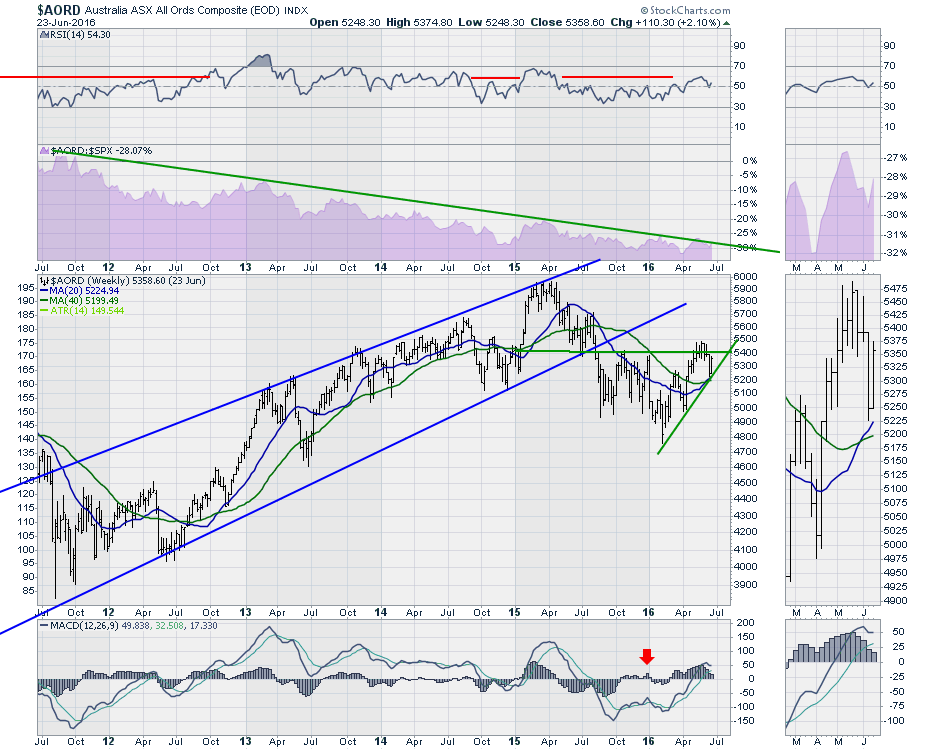

The Aussie $AORD market was trading better. A nice uptrend was approaching topside resistance. This chart shows Thursday's close.

The Aussie $AORD market was trading better. A nice uptrend was approaching topside resistance. This chart shows Thursday's close.

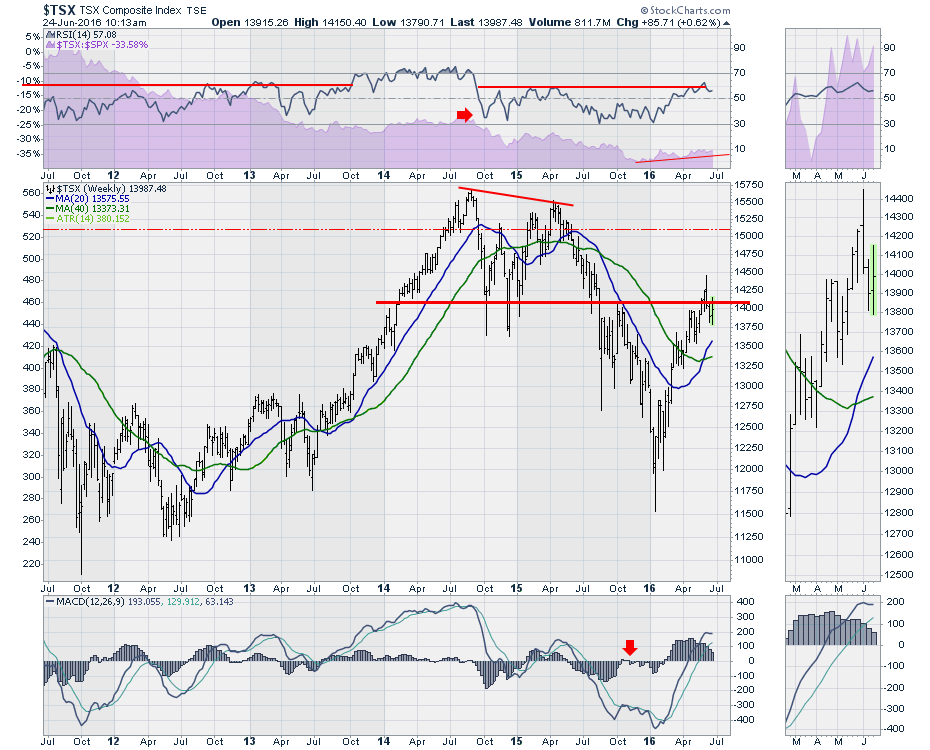

The Canadian Exchange was trying to break above 14000 which has been an important level for 10 years.

The Canadian Exchange was trying to break above 14000 which has been an important level for 10 years.

There is a lot more information on the webinar. Over the next week, we'll have to establish a plan for going through the summer. Depending on the ability of the markets to contain the exit from the Eurozone, we can see a big risk that more countries might try to vote to leave.

There is a lot more information on the webinar. Over the next week, we'll have to establish a plan for going through the summer. Depending on the ability of the markets to contain the exit from the Eurozone, we can see a big risk that more countries might try to vote to leave.

You can follow me on Twitter @Schnellinvestor and you can click on the Yes button below to subscribe to this blog so you get new articles in your inbox.

Hindsight's 20/20 and the webinar tried to outline the potential for a big upside move. We can see how the global charts were all lined up to breakout, but they did not. These will be important trendlines to monitor as time passes. Obviously, the $VIX and the precious metals rallied on the insecurity. We'll keep watching to see how this works out.

Good trading,

Greg Schnell, CMT, MFTA.