Each week I roll through my charts preparing for my Commodities Countdown Webinar. For this week's webinar, I could not be more pulled in different directions.

Which bookshelf should I be staring at? Below we can see The Time Thief, evermore, blue moon, Marked, Betrayed, Chosen, Ink Exchange, The Longing, and Change of Heart. Those titles represent the emotional swings we experienced this week! They make pretty strong Stock Market references for traders being whipsawed daily and weekly.

Then we have the books I've come to rely on in my career. Those all seem to be fighting this sideways market. The $TSX is breaking out to new highs. The US market is making a series of lower highs. The Summation Indexes are breaking down. The Bullish Percent Indexes are positioned for a breakdown. The % of stocks above the 200 DMA are breaking below the levels that usually mark a significant pullback for equities. Commodity charts are ripe for big moves, but the US Dollar Chart looks like they are about to be crushed.

Then we have the books I've come to rely on in my career. Those all seem to be fighting this sideways market. The $TSX is breaking out to new highs. The US market is making a series of lower highs. The Summation Indexes are breaking down. The Bullish Percent Indexes are positioned for a breakdown. The % of stocks above the 200 DMA are breaking below the levels that usually mark a significant pullback for equities. Commodity charts are ripe for big moves, but the US Dollar Chart looks like they are about to be crushed.

Perhaps you can join me @Commodities Countdown Webinar 2016-10-27. If you miss it live, check for the 2016-10-27 edition in the Webinar Archives.

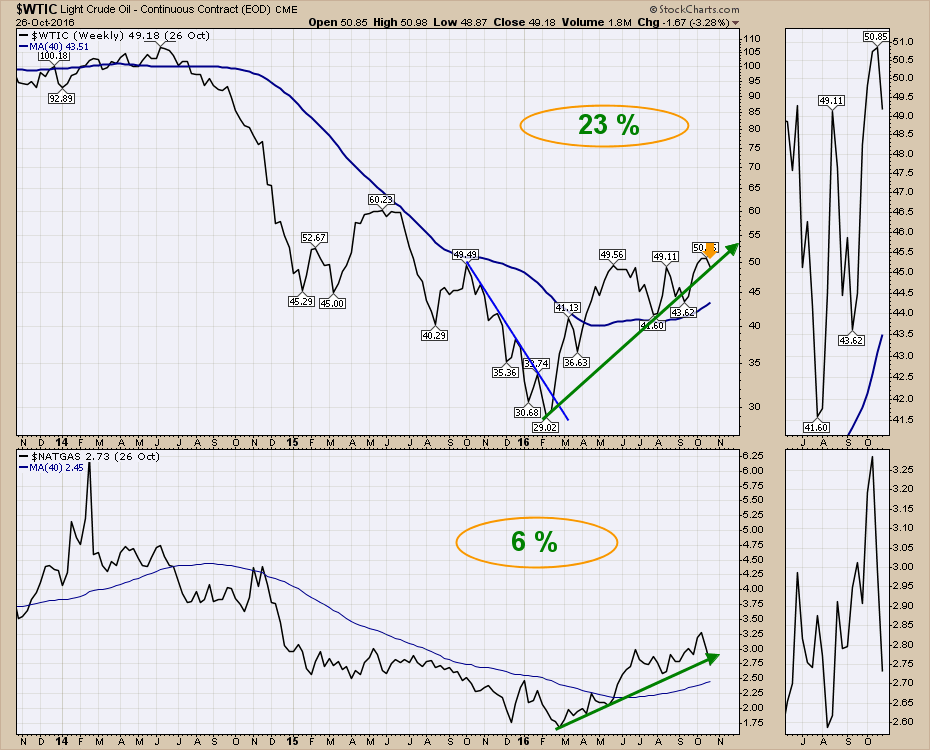

Oil is trying to hold above $50 for the third week in a row. But now Natural Gas has also deflated to $3 for the December contract. These two uptrends are being threatened as the chart shows below.

But it is the wider context with the indexes that makes this so challenging. The Russell 2000 ($RUT) is falling through support, while the $SPX trying to hold above the three-month lows.

But it is the wider context with the indexes that makes this so challenging. The Russell 2000 ($RUT) is falling through support, while the $SPX trying to hold above the three-month lows.

The monthly charts for global equities are at a major point of indecision in terms of their indicators. The cash being pulled out of the market currently makes me question what is holding the market up. Then we remember central banks are buyers of this market too. There are so many questions. I'll round up the charts and discuss the knife edge of an upcoming pain for stocks or the protagonist saves the day and we move to higher levels.

Perhaps you can join me @Commodities Countdown Webinar 2016-10-27. If you miss it live, check for the 2016-10-27 edition in the Webinar Archives.

Good trading,

Greg Schnell, CMT, MFTA.