DecisionPoint March 31, 2015 at 06:20 PM

After consolidating the correction last week, price rebounded on Monday, but it was over today as price stayed in the red all day. It consolidated in negative territory, but the end of the day price saw price fall back down and out of that area of congestion... Read More

DecisionPoint March 30, 2015 at 11:36 AM

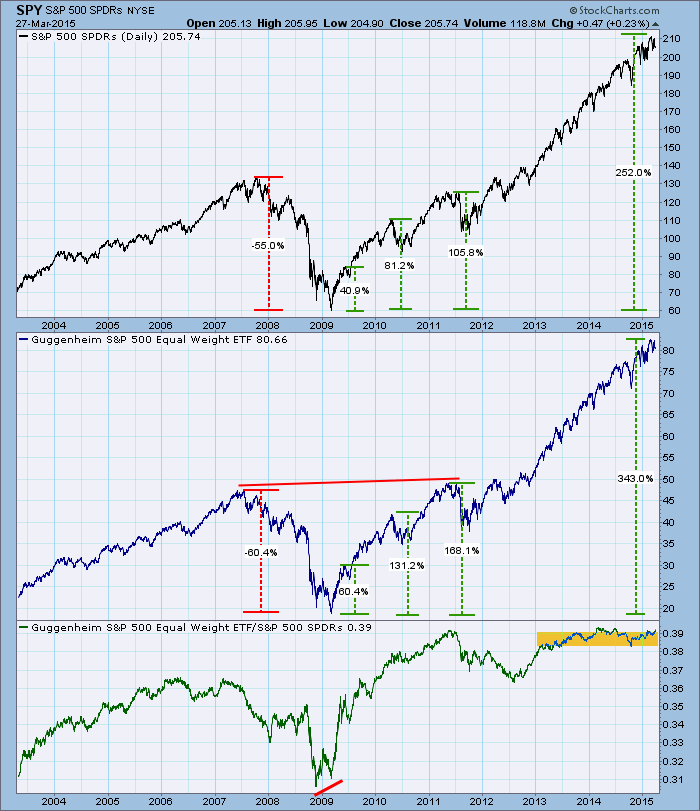

I have always been a fan of equal-weighted indexes as opposed to capitalization-weighted indexes because equal-weighted indexes generally give us more bang for the buck... Read More

DecisionPoint March 26, 2015 at 06:50 PM

I was asked a question recently about how we can use the Price Momentum Oscillator (PMO) in conjunction with the Trend Model or which do I rely on most when making investment decisions... Read More

DecisionPoint March 24, 2015 at 06:14 PM

Since reaching and nearly capturing all-time highs, price has been declining. The rounded top on the 10-minute bar chart is clear and implies price will continue lower. There is an area of support nearby at the 3/19 low, but I believe that will be taken out quickly... Read More

DecisionPoint March 22, 2015 at 11:45 PM

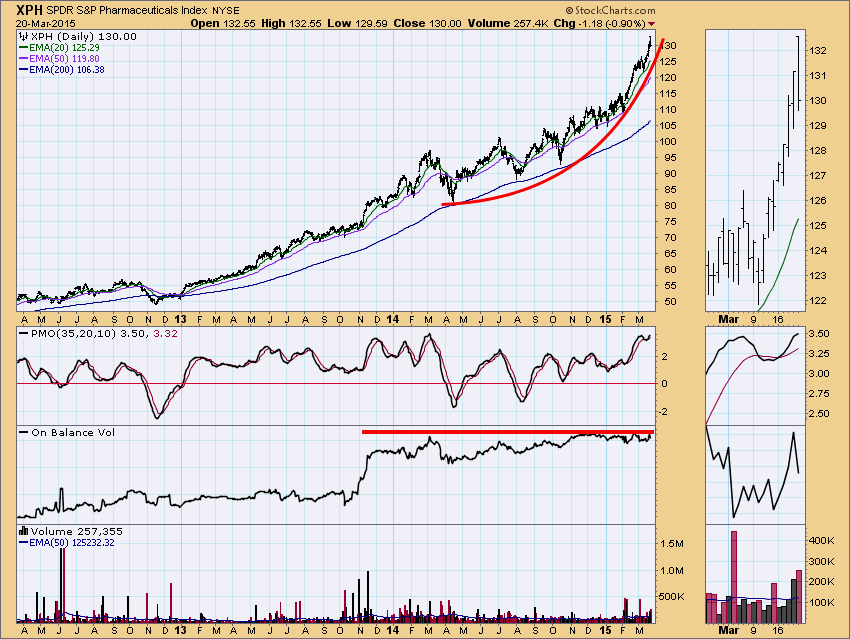

When prices arc upward at ever-increasing speed, they form a parabolic curve, which should cause us to feel ever-increasing caution... Read More

DecisionPoint March 19, 2015 at 05:50 PM

I wrote in the last issue of ChartWatchers that the DecisionPoint Intermediate-Term Trend Model went on a Neutral signal... Read More

DecisionPoint March 17, 2015 at 07:29 PM

Price didn't do much today, spending the majority nearly all day in the red. After hitting the intraday low, it trended up and managed to recoup about half of the day's losses... Read More

DecisionPoint March 16, 2015 at 10:42 AM

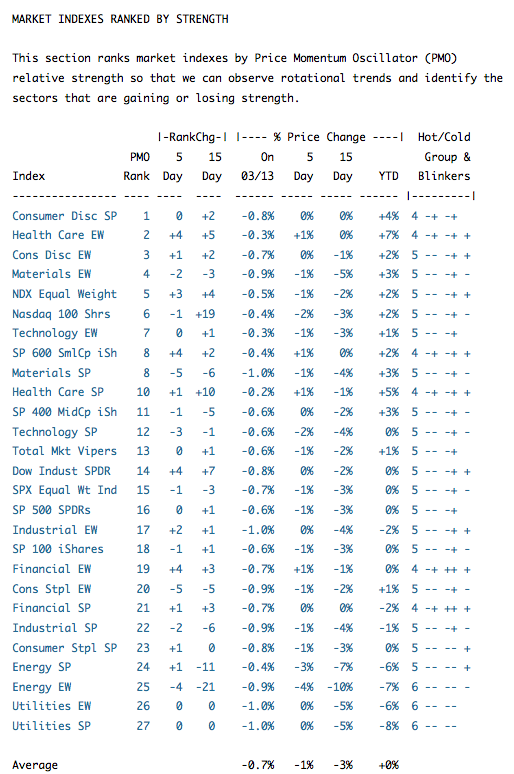

In the DecisionPoint Daily Report and Tracker reports we sort the lists by PMO (Price Momentum Oscillator) rank using the current PMO value and listing the stocks/indexes from the strongest to the weakest, but as usual, we can't take the rankings at face value... Read More

DecisionPoint March 12, 2015 at 05:49 PM

DecisionPoint covers United States Oil Fund (USO) regularly in the DP Market Update on Tuesdays, during the webinar on Wednesdays and in the DP Weekly Update on Fridays (found in DP Reports Blog)... Read More

DecisionPoint March 10, 2015 at 07:07 PM

Yesterday, price managed to turn up and scalp some losses, but today prices gapped down and continued lower, basically taking over where it left off on Friday... Read More

DecisionPoint March 10, 2015 at 02:52 PM

The McClellan Oscillator is a venerable indicator that was introduced in the late 1960s by Sherman and Marian McClellan... Read More

DecisionPoint March 10, 2015 at 01:25 AM

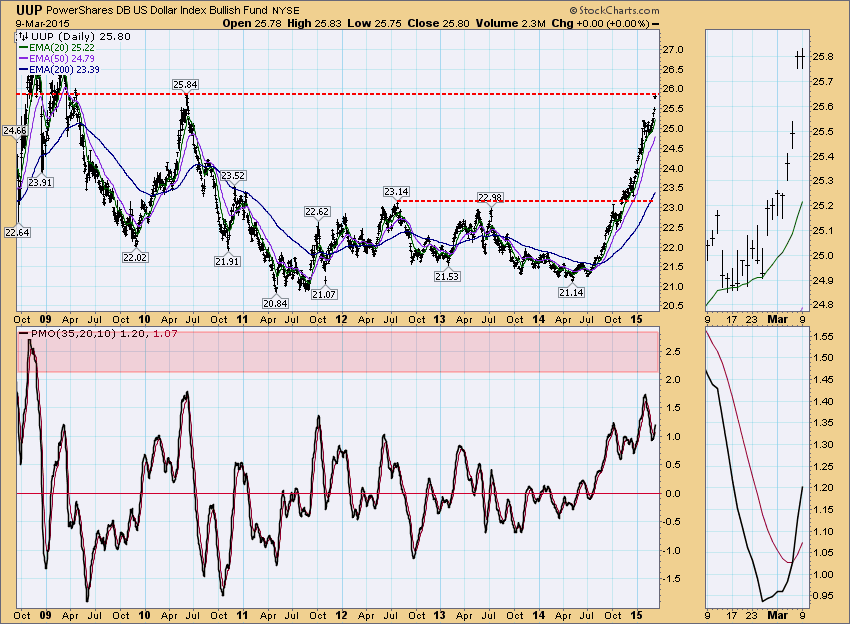

Last Friday the dollar gapped up to reach overhead resistance at the 2010 high. Looking at UUP, the dollar ETF, we see that today, resistance held. The question now is whether it will be able to break out and set a new multi-year high... Read More

DecisionPoint March 05, 2015 at 09:02 PM

On February 19th I wrote a blog article on the Energy Sector and its possible resurgence as both the Energy SPDR (XLE) and the equal-weighted sister Rydex Energy ETF (RYE) had gone on Intermediate-Term Trend Model BUY signals following Short-Term Trend Model BUY signals... Read More

DecisionPoint March 03, 2015 at 05:59 PM

Prices corrected through mid-day but managed to pare down some of the losses with a late-day rally. You can see that price has been in a continuation pattern for over a week... Read More

DecisionPoint March 02, 2015 at 04:32 PM

A good way to gauge internal strength is by examining the percentage of stocks above their moving averages. On the chart below we can see the percentage of S&P 500 stocks above their 20EMA (short-term), 50EMA (medium-term) and 200EMA (long-term)... Read More