DecisionPoint October 29, 2015 at 08:24 PM

While scanning my charts for my DecisionPoint Alert daily market review, I happened on the S&P 500 Price Momentum Oscillator (PMO) Analysis chart. It didn't look as I would've expected... Read More

DecisionPoint October 27, 2015 at 07:11 PM

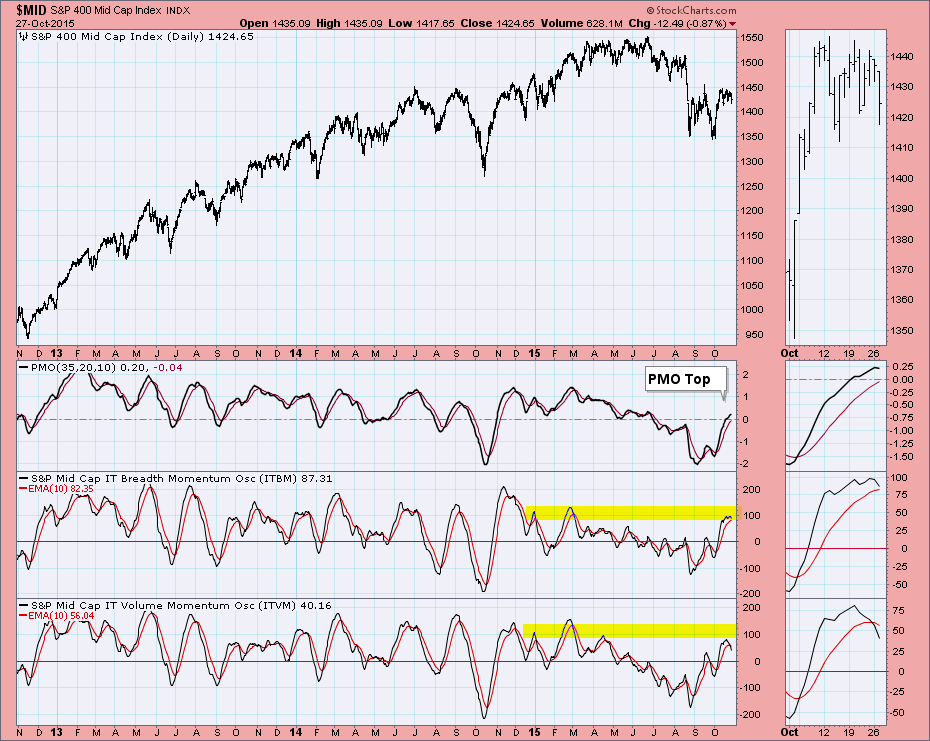

Last week I wrote my blog article about small and mid cap stocks not participating in the recent rally which is a sign of instability in the market as a whole... Read More

DecisionPoint October 25, 2015 at 11:47 AM

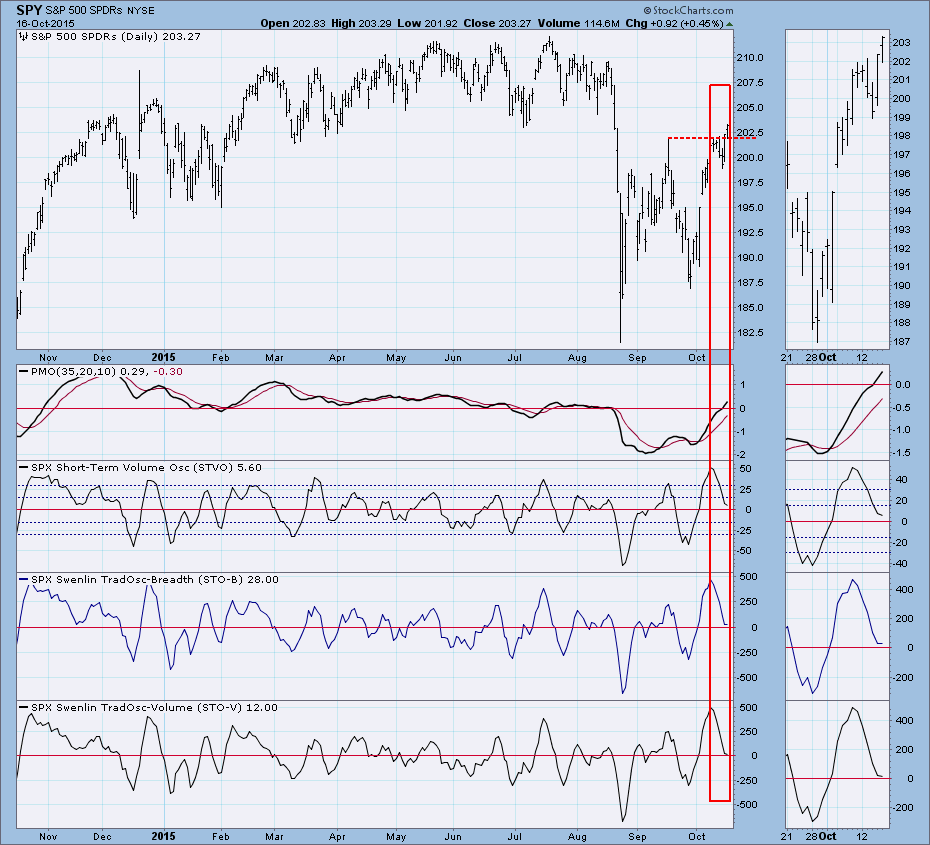

After the strong upside price action we've had in the last two days, I was expecting to see strong internal readings as well. But no. While price is within about two percent of record highs, internal readings are fading... Read More

DecisionPoint October 22, 2015 at 07:35 PM

It was pointed out to me that small- and mid-cap stocks were not participating in the recent rally in comparison to the major indexes on our DP Scoreboards that I've recently covered in previous blogs. I called up three charts, the S&P 400, S&P 600 and the Russell 2000 ETF (IWM)... Read More

DecisionPoint October 20, 2015 at 08:35 PM

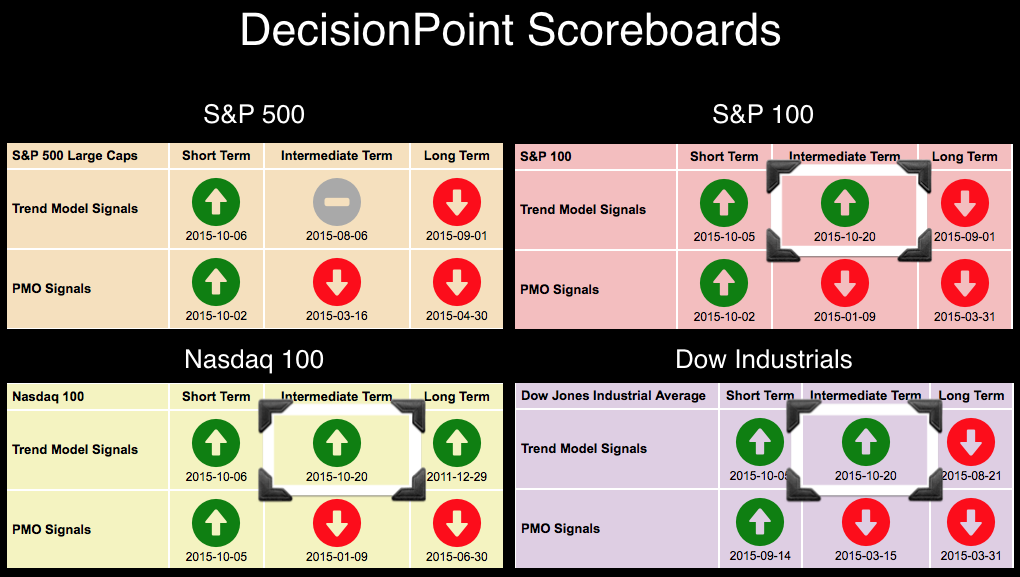

The bear market rally has now extended to Intermediate-Term Trend Model BUY signals. You'll see in the DP Scoreboards below that the Nasdaq 100, S&P 100 and Dow flipped to BUYs... Read More

DecisionPoint October 18, 2015 at 12:01 AM

Based upon the fact that the 50EMA is below the 200EMA, I consider that we are in a bear market, and that we should expect negative outcomes more often than positive ones; however, we should remember that positive outcomes are also possible some of the time... Read More

DecisionPoint October 16, 2015 at 02:04 AM

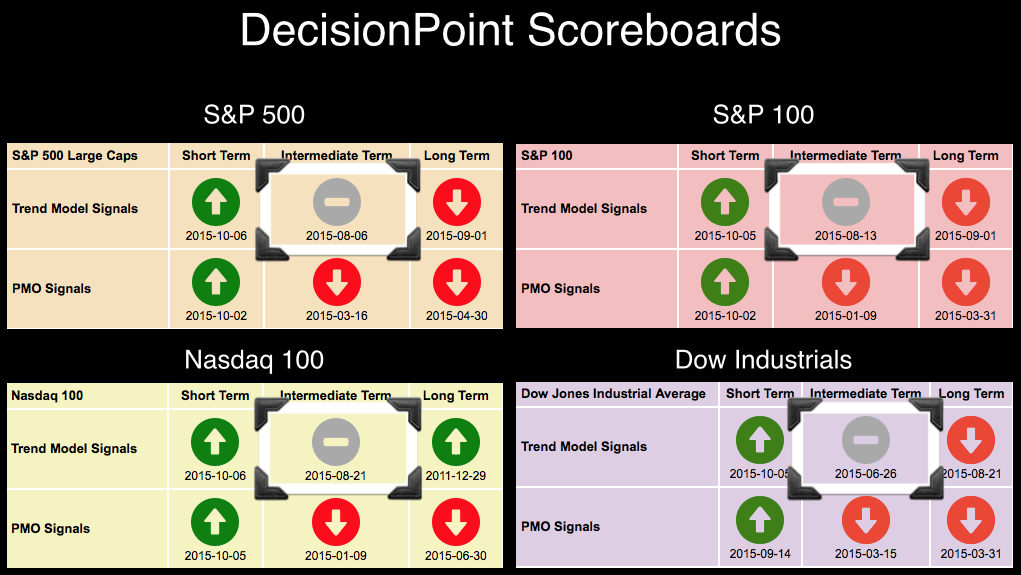

I recently received an email from a reader who asked me why the neutral signals on the had not turned to red Sell signals. First there is the technical reason and then there are the charts. The technical reason is that our DecisionPoint Trend Model only changes on crossovers... Read More

DecisionPoint October 10, 2015 at 11:29 PM

On Wednesday of last week $GOLD generated a DecisionPoint Trend Model BUY signal when the 20EMA crossed up through the 50EMA. As we frequently stress, these signals are intended to be information flags, not action flags. They should prompt investigation, not blind response... Read More

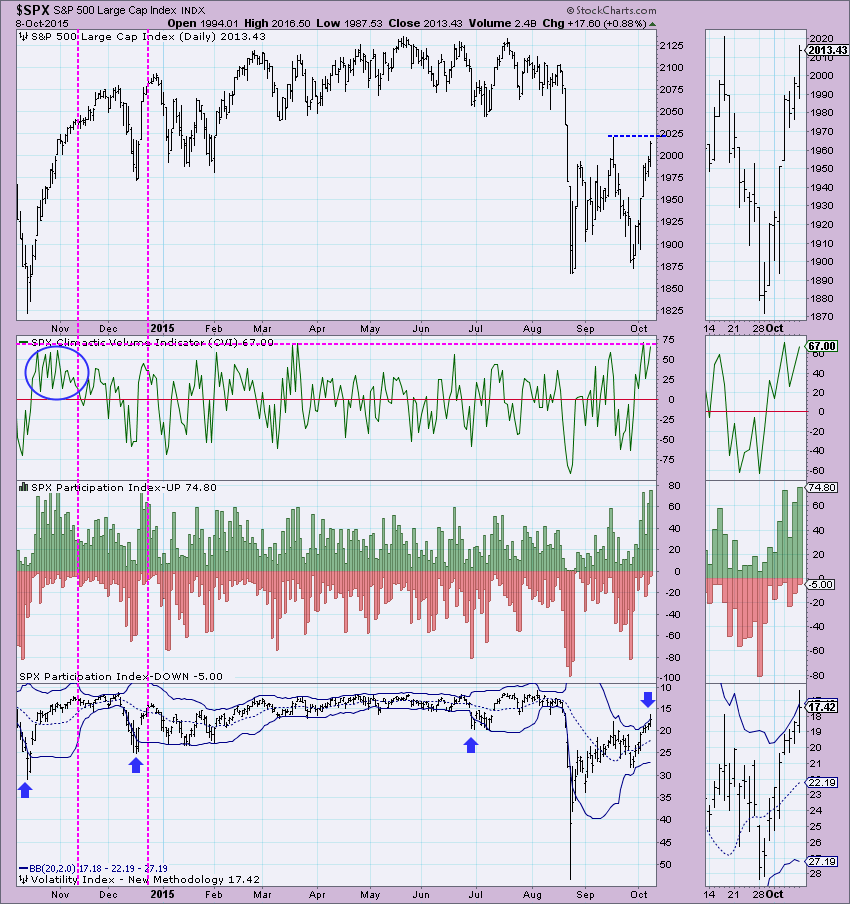

DecisionPoint October 08, 2015 at 10:34 PM

I really appreciate receiving your questions, emails and webinar comments. They so often will spur an article and it likely is of interest to many others if someone took the time to send it to me. So here is today's question: "As for short term indicators, e.g... Read More

DecisionPoint October 07, 2015 at 12:10 AM

I received a question from a reader that I thought would make a great article: "Can you explain if there is any significance to spike on the Total Assets Rydex Bear Index Funds chart?" First, a quick refresher on the Rydex Asset Ratio... Read More

DecisionPoint October 03, 2015 at 11:17 PM

This is one of my favorite charts, although I look at it infrequently because it's a little like watching grass grow... Read More

DecisionPoint October 01, 2015 at 07:44 PM

The title "suggest more upside" refers to the short term, not the intermediate or long terms. We are still in a bear market, a genuine bear market, so we shouldn't expect bullish results. However, even within a bear market, there are rallies... Read More