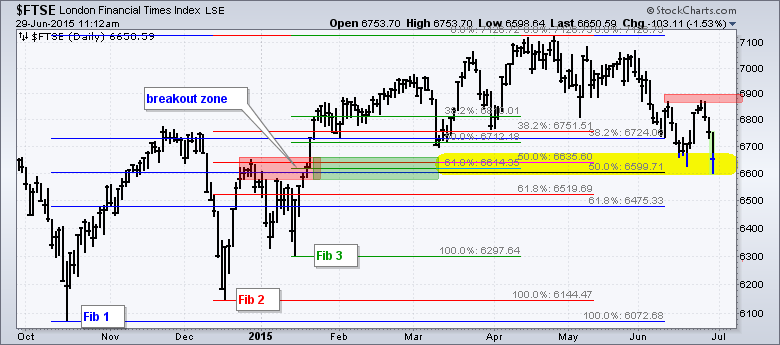

Don't Ignore This Chart! June 29, 2015 at 06:24 AM

Today's post is for our UK traders because it focuses on the FTSE and three of the biggest banks in the UK. Shares in Europe were sharply lower in early trading on Monday with the German DAX Index ($DAX) and French CAC Index ($CAC) losing around 3%... Read More

Don't Ignore This Chart! June 27, 2015 at 01:55 PM

Amazon.com (AMZN) continues to reach for the stars and if the current technical pattern plays out, it'll likely be much closer... Read More

Don't Ignore This Chart! June 26, 2015 at 03:32 PM

Footwear is one of the best performing industry groups recently. The Dow Jones Footwear Index soared to new highs this week. It was the fifth best group over the last month, and fourth best over the last week... Read More

Don't Ignore This Chart! June 25, 2015 at 02:30 PM

IPGP resides in the semiconductor industry and is pulling back with this industry group as June has proven to be a very rough month for this space. I'm expecting that to soon change and IPGP could be a direct beneficiary... Read More

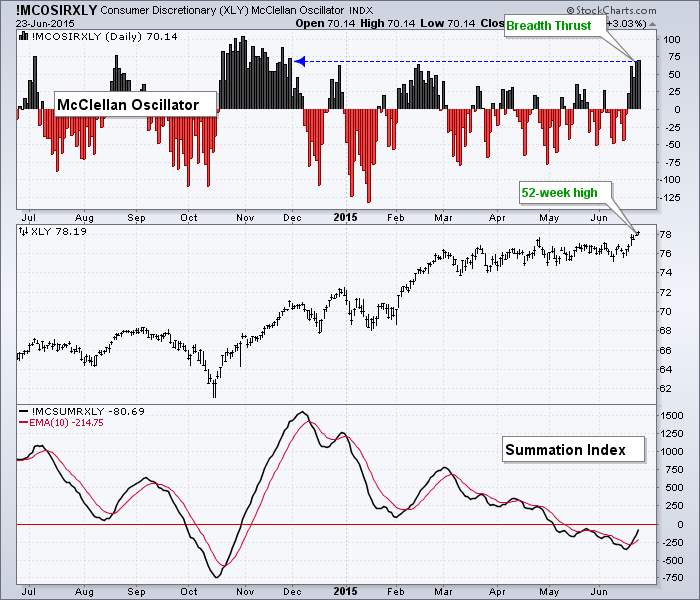

Don't Ignore This Chart! June 24, 2015 at 06:43 AM

StockCharts users have access to the McClellan Oscillators and Summation Indices for the nine sector SDDRs and the major stock indices... Read More

Don't Ignore This Chart! June 23, 2015 at 03:54 PM

Rite-Aid (RAD) has a very interesting chart formation this week. Recently the stock surged to long term highs. As it continues to battle against the resistance levels, we can see $8.75 seems to be an important area for the stock. It struggled to push above $8.75 in early April... Read More

Don't Ignore This Chart! June 22, 2015 at 03:02 PM

Vertex (VRTX) is part of the healthcare sector, which is one of the strongest sectors in the market. It is also part of the biotech industry, which is one of the strongest industry groups in the healthcare sector... Read More

Don't Ignore This Chart! June 19, 2015 at 07:46 AM

Well, the US Dollar ($USD) has certainly created some broad moves in the markets throughout last year with a massive thrust out of a trading range mid 2014. We can see it was almost exactly one year ago that the dollar started from its July low... Read More

Don't Ignore This Chart! June 18, 2015 at 08:00 AM

The Federal Reserve on Wednesday suggested the pace on increasing interest rates would be slower than previously thought. There was renewed interest in treasuries and the 10 year treasury yield dropping nearly 10 basis points in the two hours following the Fed policy statement... Read More

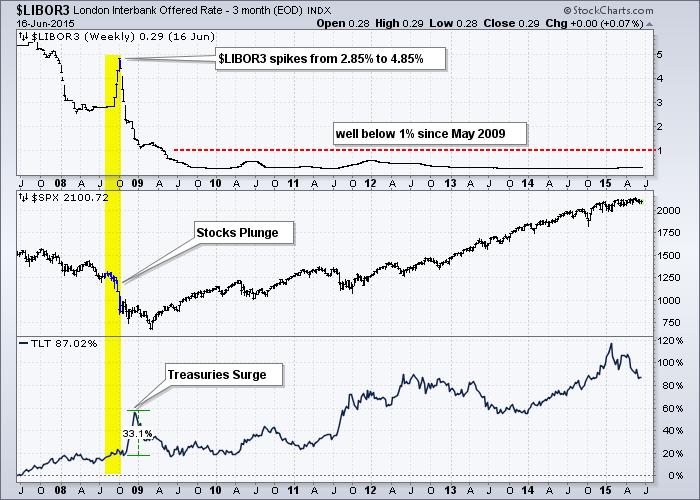

Don't Ignore This Chart! June 17, 2015 at 10:36 AM

Many of us remember the financial crisis in 2008 when Lehman collapsed and the credit markets froze. The S&P 500 plunged some 40% and the 20+ YR T-Bond ETF (TLT) surged over 30% in a flight to quality. This was a true financial crisis and the markets reflected this crisis... Read More

Don't Ignore This Chart! June 16, 2015 at 08:02 PM

Alkermes (ALKS) appears to be a highly specialized Biotech working on rare conditions to help with managing the effect of the condition. Recently Alkermes (ALKS) took a tumble and the stock dropped from $75 to $55. Can it recover? First of all, the SCTR has popped back up... Read More

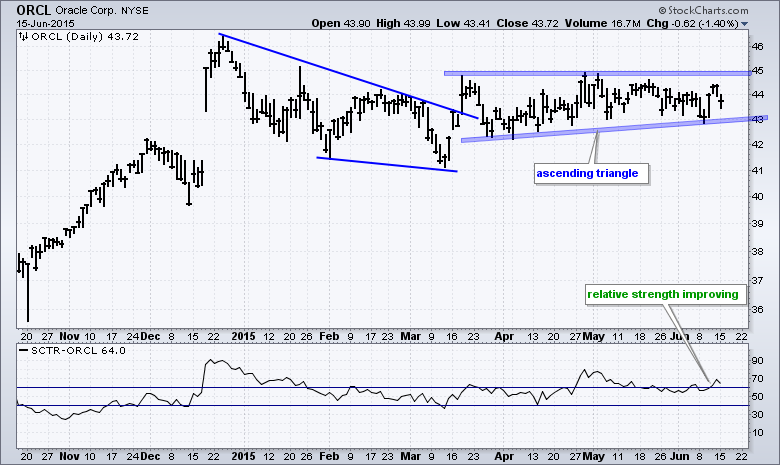

Don't Ignore This Chart! June 15, 2015 at 01:24 PM

Two stocks associated with the Golden State Warriors are showing promise as Step Curry leads his team to a 3-2 lead in the series. The Warriors play in the Oracle Arena and Oracle (ORCL) is making waves with an ascending triangle... Read More

Don't Ignore This Chart! June 13, 2015 at 01:52 PM

There hasn't been much positive news to tweet about at Twitter (TWTR) lately. In the midst of its downward spiral in price action, CEO Dick Costolo announced he would be resigning from TWTR and TWTR's co-founder and Chairman Jack Dorsey would take over... Read More

Don't Ignore This Chart! June 12, 2015 at 07:57 AM

GotoMeeting is clearly one of the leaders in the online meeting world. Citrix Systems (CTXS) is the owner of GotoMeeting and a host of other less known software solutions. Yesterday Elliott Management announced a 7... Read More

Don't Ignore This Chart! June 11, 2015 at 02:47 PM

Mobileye (MBLY) is one of the companies behind the car crash avoidance technology. MBLY broke its downtrend line in early March on surging volume and has been trending higher ever since... Read More

Don't Ignore This Chart! June 10, 2015 at 09:40 AM

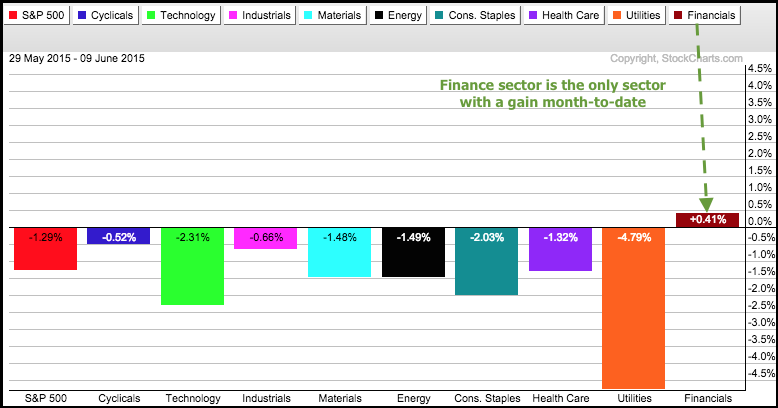

Eight of the nine sector SPDRs are down month-to-date and the S&P 500 SPDR (SPY) is also down (as of the 9-June close). One sector, however, is bucking the trend with a small gain... Read More

Don't Ignore This Chart! June 09, 2015 at 12:50 PM

AT&T (T) continues to push higher. This week the SCTR has reached 75 again. Is the internet of things starting to kick in for the Telco's? Check out the rising lows on the consolidation for AT&T. 5 of the last 7 weeks have had big volume on up weeks... Read More

Don't Ignore This Chart! June 08, 2015 at 03:33 PM

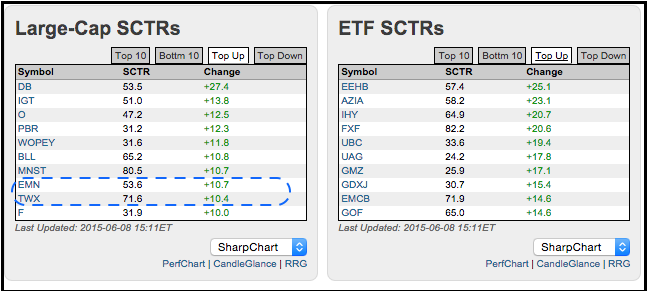

Chartists looking for the "relative strength" movers and shakers of the day can focus on the stocks and ETFs with the biggest changes in their StockCharts Technical Rank (SCTR)... Read More

Don't Ignore This Chart! June 07, 2015 at 01:58 PM

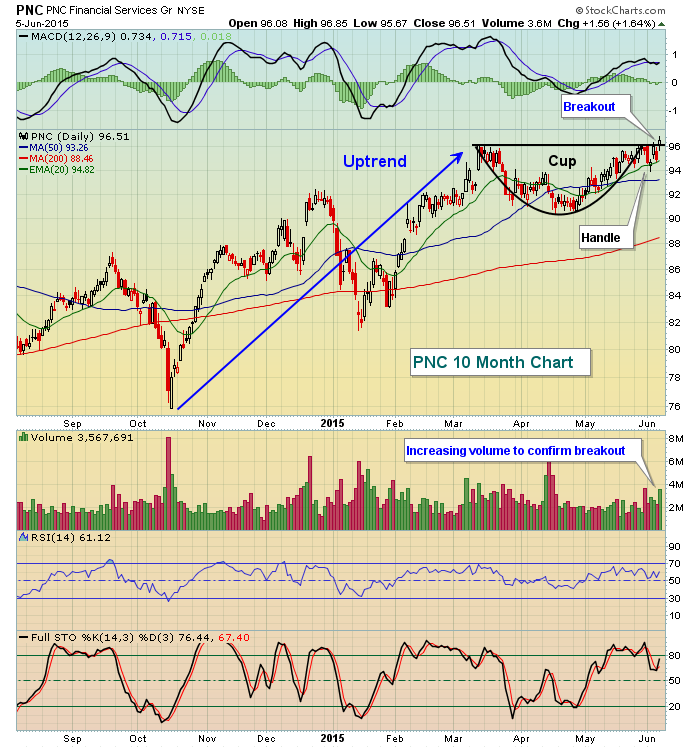

Money is rotating towards financial stocks as the market prepares for what appears will be Fed tightening later in 2015 into 2016. Higher yields on treasuries and a steepening yield curve generally increase net interest margin, the key metric in bank earnings... Read More

Don't Ignore This Chart! June 05, 2015 at 12:47 PM

Bank of America (BAC) has been a wild ride for swing traders. The faster ones will have made some money. The slower ones will have been stopped out both directions, time after time. The Buy and Holders have been worked over on their conviction. $16... Read More

Don't Ignore This Chart! June 04, 2015 at 12:34 PM

JP Morgan downgraded Verizon (VZ) this morning, instead choosing AT&T (T) and that has put pressure on VZ in the early going. Thus far, buyers have emerged and VZ has risen off its opening gap lower... Read More

Don't Ignore This Chart! June 03, 2015 at 05:39 AM

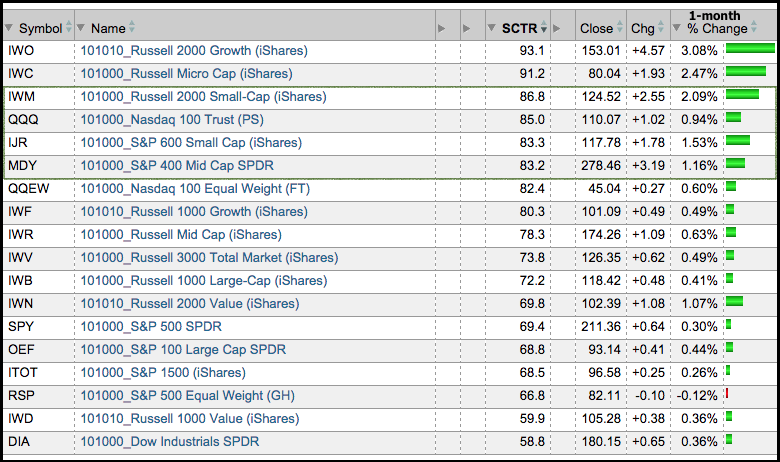

May was a strong month for big tech stocks, small caps and mid caps. It was such a big month that the Russell 2000 iShares, S&P SmallCap iShares and S&P MidCap SPDR are in the top third of the SCTR table below... Read More

Don't Ignore This Chart! June 02, 2015 at 12:32 PM

Endo Pharmaceuticals (ENDP) has been on a recent pullback from a wonderful uptrend... Read More

Don't Ignore This Chart! June 01, 2015 at 03:50 PM

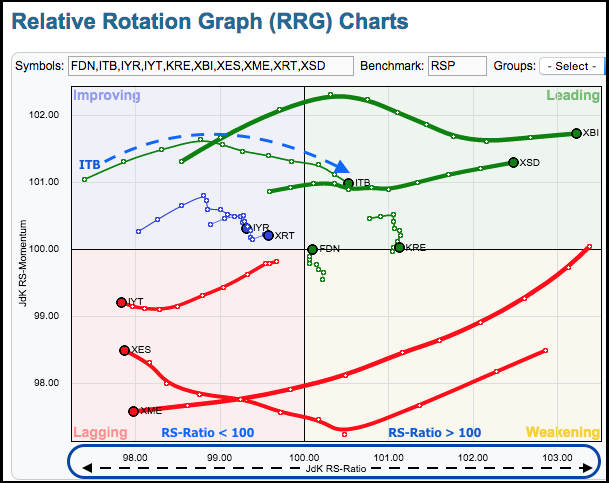

The Home Construction iShares (ITB) is showing some improvement in relative performance with a move from the improving quadrant to the leading quadrant over the last few days... Read More