Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but we will try to incorporate a few charts that you found the most interesting during the show (or that we found most interesting!). Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE, Email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE.

What Happened Today?

Market Update/Economic News/Earnings:

Every Wednesday, Tom and Erin start the show off with important earnings announcements, economic news and developing news in the major markets. Tom mentioned that Bank of America reported good earnings but the market didn't really react as expected which isn't good for the sector or market.

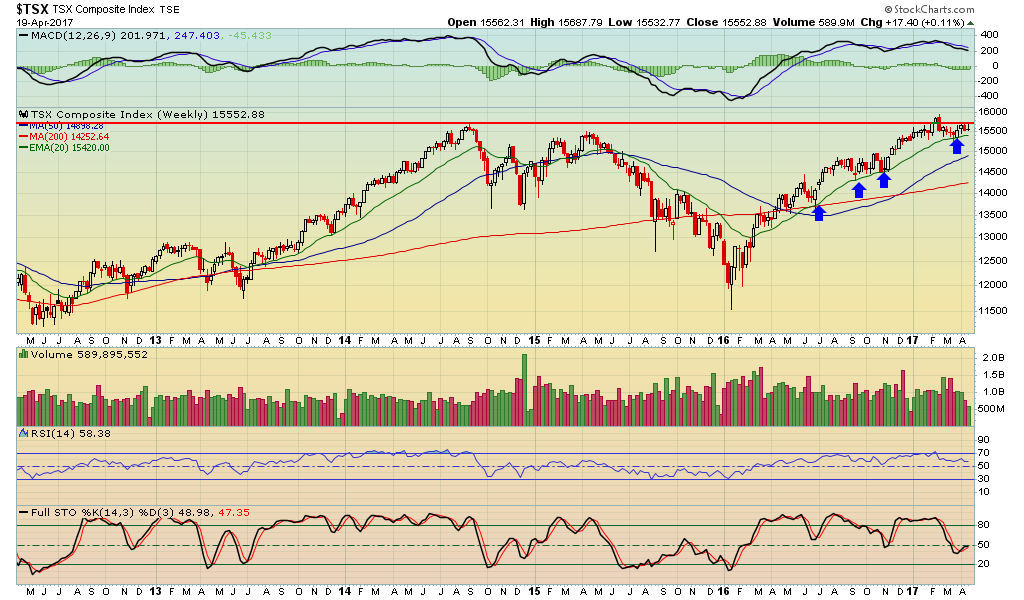

Eye on ETFs/International ETFs: On Wednesday Tom and Erin look at which ETFs or sectors are leading/lagging using RRG charts and the International ETF Summary. As part of the international review, Tom called up the chart on $TSX. Both he and Erin are bearish.

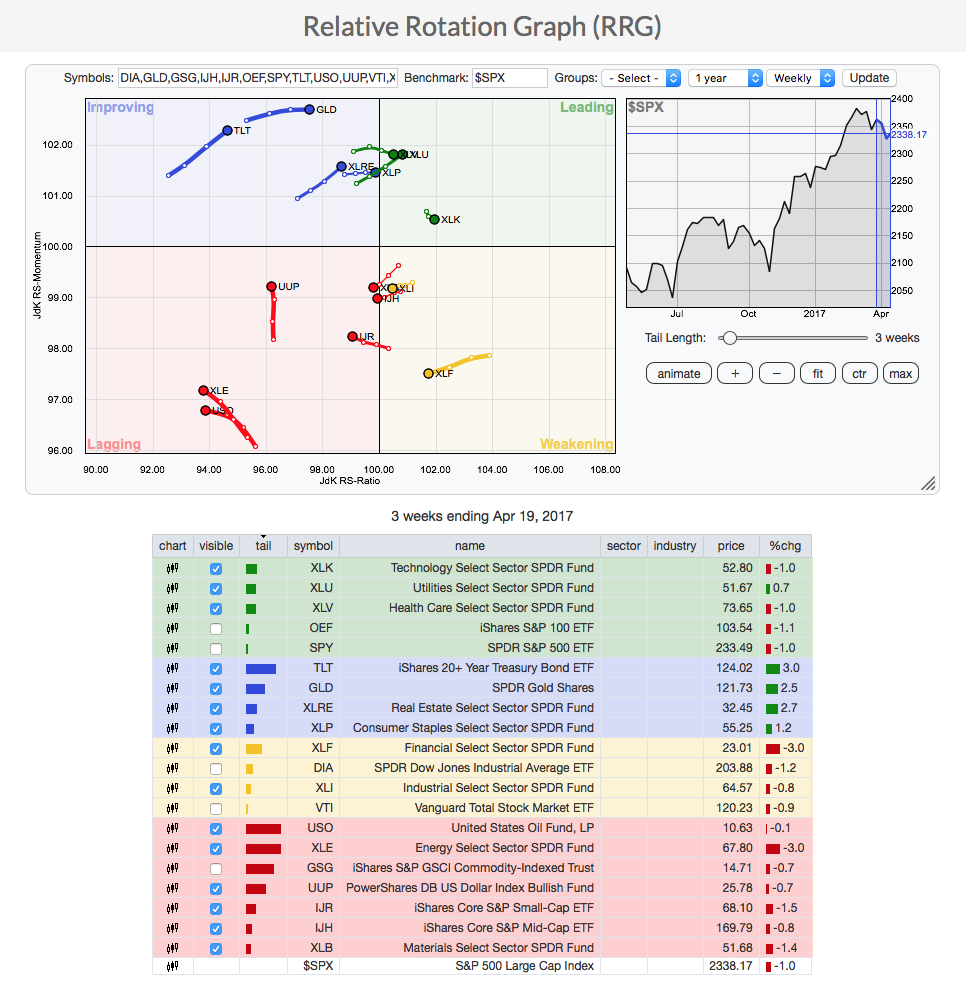

Below is Erin's RRG chart. Both Tom and Erin noted that we continue to see money flowing into more 'defensive' sectors like Gold, Real Estate, Utilities, Consumer Staples, among others.

Market Updates: Erin reviews the intraday action of the major indexes, sectors and the "Big Four", (Dollar, Gold, Oil & Bonds). For a detailed review, read the latest DecisionPoint Alert in the DecisionPoint blog.

Agree or Disagree? In this regular segment, Tom and Erin will look at two charts and agree or disagree. Erin posts the Agree or Disagree polls on Twitter to find out what you think. The current Twitter polls are here. Today Erin and tom reviewed the $CRB index and Percent of Stocks Above their 50-MA. In both cases, Tom and Erin were both bearish. Here's Erin's chart on Percent Stocks Above Their 20/50/200-EMAs. Price is reaching critical support. We will need to see these percentages start climbing if there is to be a bounce off support.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments and comments from the Twitter "peanut gallery" peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. If we missed them this show, we have many of them in the queue for Friday. Tom looked at AT&T (a viewer request). Biggest concern is the drop below 20-MA and holding support at the $40 level. If support holds, could see a move to test highs around $42.25.

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Tom discussed why he likes to use the 20-MA in conjunction with the MACD and support/resistance. Erin talked about how she uses "CandleGlance" to pick possible trades. For more about Erin's use of CandleGlance, here is an educational article.

It's a Wrap! In closing Erin discussed the Twitter viewer poll from Friday. The majority of viewers felt the market would rally today and they appeared to be right. Look for our Twitter polls at @mktwatcherslive.

Looking Forward:

Tune in on Friday at 12:00p - 1:30p EST on XX/XX for our viewer-centric program. We will run real-time polls and focus on your symbol requests and questions!