Top Advisors Corner October 30, 2014 at 01:31 PM

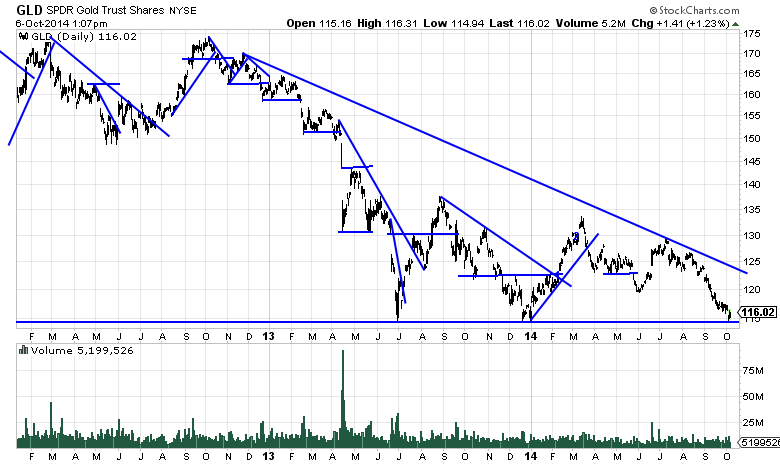

Monitoring purposes SPX: Sold 9/30/14 at 1972.29= gain .003%; Long SPX on 9/25/14 at 1965.99. Monitoring purposes GOLD: Gold ETF GLD long at 173.59 on 9/21/11 Long Term Trend monitor purposes: Flat The chart above goes back to mid 2007... Read More

Top Advisors Corner October 29, 2014 at 01:40 PM

High Frequency Traders HFTs are usually easily seen on stock charts with huge gaps, long one day candles, and spiking volume patterns. However their counterpart which is the long term mutual and pension fund institutions, are often harder to see and identify... Read More

Top Advisors Corner October 27, 2014 at 01:54 PM

The market has had a nice run-up ahead of the Fed meeting that begins Tuesday and has the economy on the agenda on Wednesday... Read More

Top Advisors Corner October 24, 2014 at 06:08 PM

Greetings from Geneva Switzerland! “Buy the dips”, they say, and watch the market take off like a hot air balloon... Read More

Top Advisors Corner October 24, 2014 at 03:17 PM

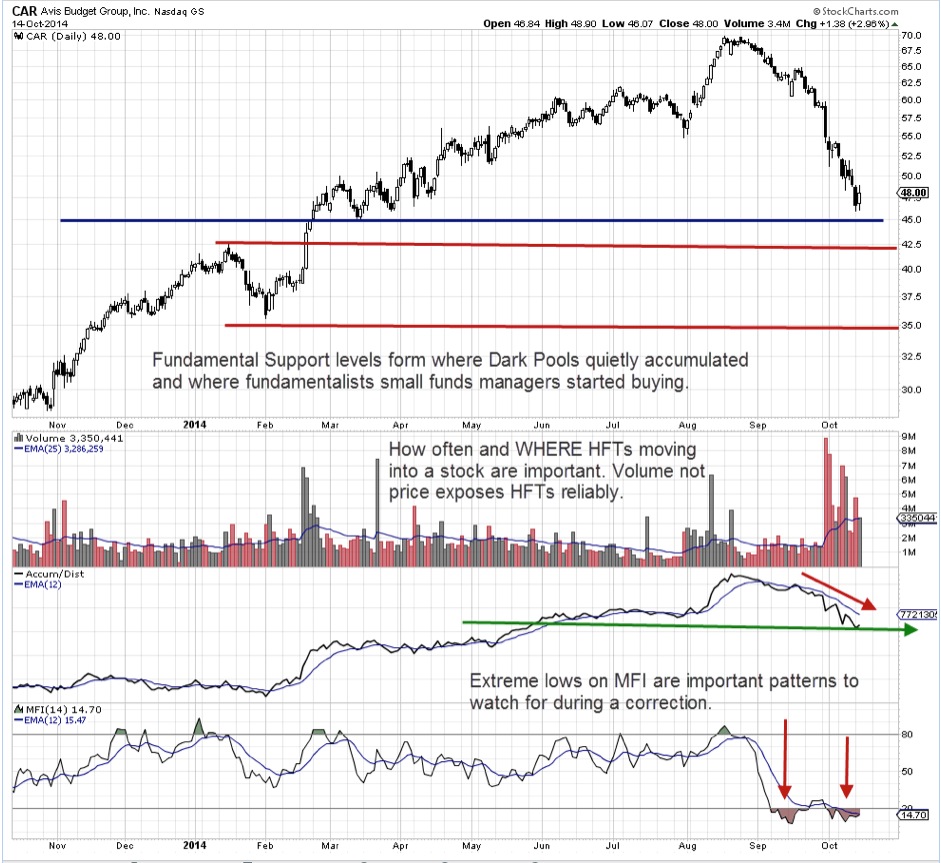

How To Determine Where Price Will Find Support During A Downtrend Technical Traders often forget that there are two different perspectives on support and resistance... Read More

Top Advisors Corner October 24, 2014 at 03:12 PM

Slice & dice volatility - dominates this week's activity. Not to be overlooked at all: this approaches the fiscal year-end of many funds; so they tried their best, may yet-again, to deliver the best results they can to close-out their year... Read More

Top Advisors Corner October 23, 2014 at 01:51 PM

I cannot believe the volume of the news stories I am seeing in the financial media, with people worrying about impending deflation. And as any card-carrying contrarian knows, when a topic gets too popular, you are near a turning point... Read More

Top Advisors Corner October 23, 2014 at 01:48 PM

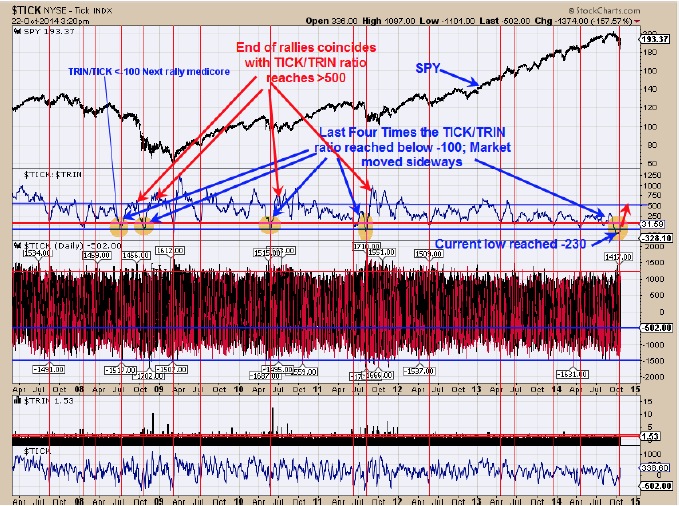

Monitoring purposes SPX: Sold 9/30/14 at 1972.29= gain .003%; Long SPX on 9/25/14 at 1965.99. Monitoring purposes GOLD: Gold ETF GLD long at 173.59 on 9/21/11 Long Term Trend monitor purposes: Flat The top window is the SPY and the window below that is the TICK/TRIN ratio... Read More

Top Advisors Corner October 22, 2014 at 03:10 PM

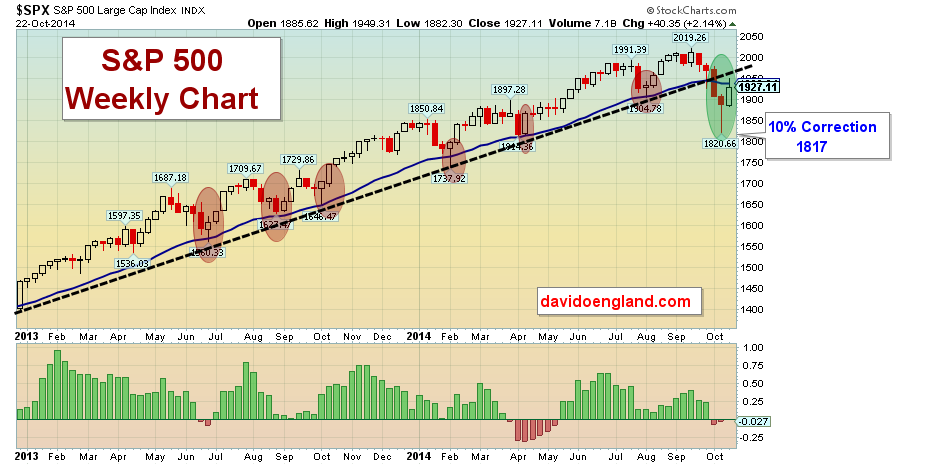

On October 12th I wrote, “To signal an upcoming correction, turn off the hype from the national media and watch two simple items: my blue signal line and longer-term trend line. Remember the saying “The trend is your friend?” It works in this situation also... Read More

Top Advisors Corner October 21, 2014 at 01:37 PM

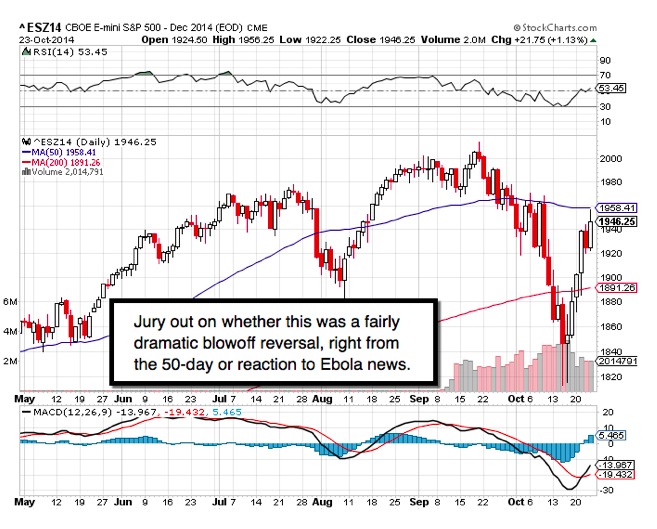

I'd anticipated a snapback off the 10% down-move on the S&P 500, with a retrace to around the gap at 1928, or thereabouts. Thus far, the market is playing out as expected. Of course, we could go somewhat higher or lower than my target... Read More

Top Advisors Corner October 21, 2014 at 01:36 PM

The death of the Bear - now proclaimed by so many money managers might be premature (that's the subject of this weekend's report, after a fabulous two weeks during which we basically harvested downside S&P gains in-excess of 100 handles, if not more; and with that under-belt; we'... Read More

Top Advisors Corner October 18, 2014 at 10:50 AM

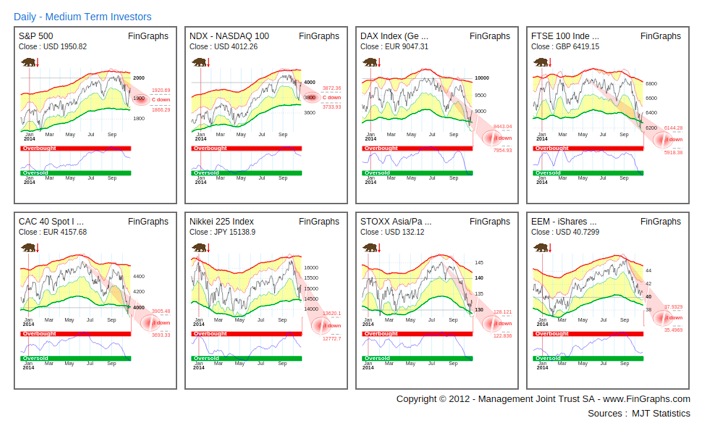

Hello everyone! Talk about the deepest equity market correction since Spring 2012 and it raises three questions: is it the beginning of the end of the 2009-2014 Bull market?, where will this yet secondary correction find support? what can be expected from the current bounce? Thre... Read More

Top Advisors Corner October 17, 2014 at 01:42 PM

Reading A Chart’s Support And Resistance Levels Requires More Analysis Than Price Patterns This week’s stock discussion is regarding Avis Budget Group, Inc... Read More

Top Advisors Corner October 17, 2014 at 01:35 PM

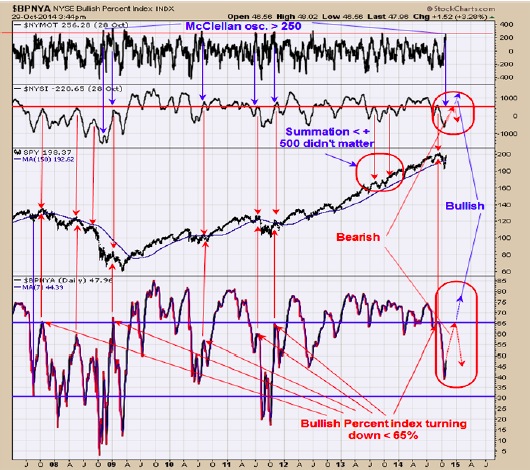

When the McClellan A-D Summation Index makes a big move in a short amount of time, that action contains important information. This week, I’ll show a pair of charts that help to make this point. The Summation Index changes each day by the value of the McClellan Oscillator... Read More

Top Advisors Corner October 16, 2014 at 03:17 PM

It is time for another "best of breed" books that make great gifts for investors and traders. My heart is in financial education, with the goal "to teach my students how to make better-educated financial decisions... Read More

Top Advisors Corner October 16, 2014 at 12:08 PM

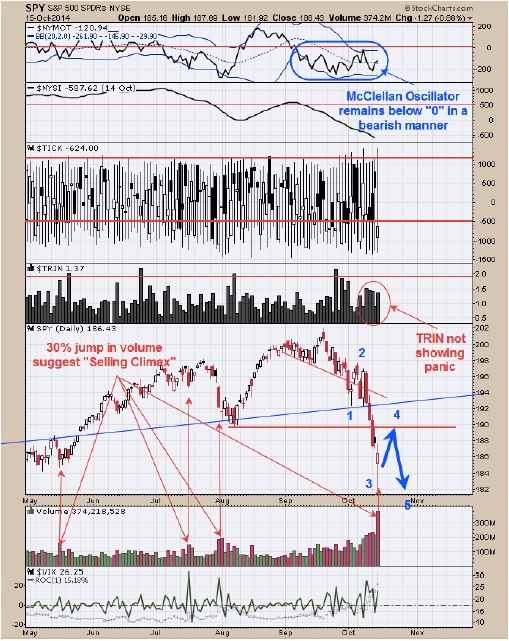

Monitoring purposes SPX; Sold 9/30/14 at 1972.29= gain .003%; Long SPX on 9/25/14 at 1965.99. Monitoring purposes Gold: Gold ETF GLD long at 173.59 on 9/21/11... Read More

Top Advisors Corner October 16, 2014 at 12:02 PM

The market was primed to go higher today as Intel Corporation (INTC) and CSX Corp. (CSX), two key market leaders, were rocking after hours last night after reporting earnings... Read More

Top Advisors Corner October 13, 2014 at 01:32 PM

Chaikins Money Flow as a Volume Volatility Indicator Chaikins Money Flow CMF is commonly used as a momentum indicator, however it is also an excellent volatility indicator that enables technical traders to evaluate volatility or lack thereof during Trading Range conditions which ... Read More

Top Advisors Corner October 13, 2014 at 01:28 PM

A 'tipping point' arrived - in the week just past... Read More

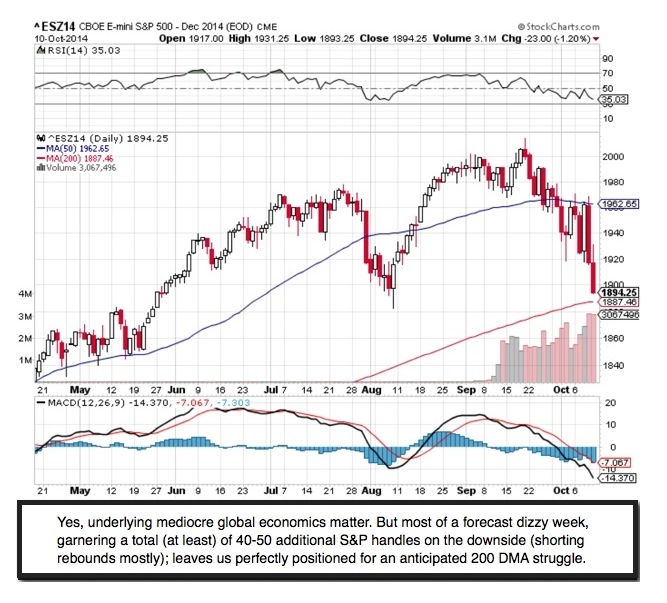

Top Advisors Corner October 10, 2014 at 11:59 AM

Last week I pointed out how the Commitment of Traders (COT) Report data for currencies were pointing to a big topping condition for the dollar... Read More

Top Advisors Corner October 10, 2014 at 11:54 AM

Monitoring purposes SPX; Sold 9/30/14 at 1972.29= gain .003%; Long SPX on 9/25/14 at 1965.99. Monitoring purposes Gold: Gold ETF GLD long at 173.59 on 9/21/11. Long Term Trend monitor purposes: Flat We are Still expecting a bottom to form this week to early next week... Read More

Top Advisors Corner October 08, 2014 at 01:24 PM

Today I answer: “Using your technical analysis tools, what will you be watching to see if we are headed for a correction?” Before I answer, keep in mind a correction is a 10 percent pullback from a previous high... Read More

Top Advisors Corner October 07, 2014 at 03:12 PM

So the bears had the bulls dead in the water a few days back. The long-term, up-trend line at 1950 had been taken out with some force, down to 1926 intraday on Thursday. This was it. This was their time. Bulls finally knocked out cold... Read More

Top Advisors Corner October 06, 2014 at 01:45 PM

The U.S. Dollar Index has recently been in one of the biggest blowoff moves we have seen in years. The lesson of the past blowoffs is that the downward slope out of the eventual top tends to symmetrically match the slope of the advance up into it... Read More

Top Advisors Corner October 04, 2014 at 01:11 PM

Gold and silver are in extended downtrends. Worse for gold it has just broken to new lows on a gap down. Being long is an invitation to a diagnosis of masochism. Buying these issues before they form bottoms and show strength is a good way to dispose of capital... Read More

Top Advisors Corner October 02, 2014 at 01:36 PM

Monitoring purposes SPX: Sold 9/30/14 at 1972.29= gain .003%; Long SPX on 9/25/14 at 1965.99. Monitoring purposes GOLD: Gold ETF GLD long at 173.59 on 9/21/11 Long Term Trend monitor purposes: Flat Today’s decline in the SPY produced a potential “Selling Climax”... Read More

Top Advisors Corner October 01, 2014 at 05:43 PM

Microsoft (NASDAQ: MSFT) Stock Chart Shows Why Watching Volume Pays Volume has become one of the most important indicators, as Dark Pools took liquidity off the exchanges and market-maker limit books while High Frequency Trading seized control of the void the giant lots left behi... Read More

Top Advisors Corner October 01, 2014 at 05:39 PM

Today I answer: “Using your technical analysis tools, were there buy signals for the recent run with GoPro?” Let’s review one of my trading systems before looking specifically at GoPro.This system is highly effective at giving profitable trading buy and sell signals... Read More