Top Advisors Corner January 28, 2016 at 10:20 AM

Monitoring purposes SPX: Neutral. Monitoring purposes GOLD: Sold GDX 1/19/16 at 12.45: Long GDX on 11/20/15 at 13.38. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28 Today and tomorrow is the FOMC meeting which may put short term volatility in the market... Read More

Top Advisors Corner January 22, 2016 at 11:58 AM

Global ripple effects - were again evident prior to Davos and all the reflections (generally after-the-fact) on market risk versus opportunity bantered about... Read More

Top Advisors Corner January 22, 2016 at 11:50 AM

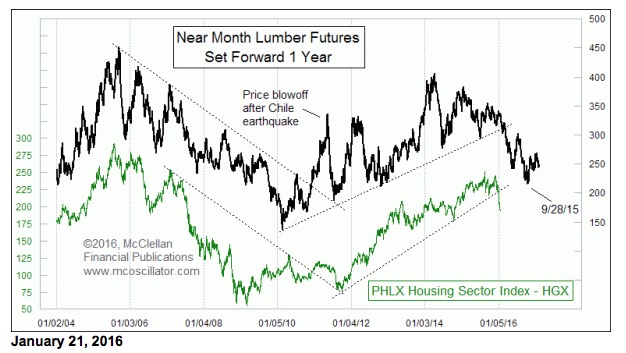

Who cares about lumber futures prices? You should, if you care about housing sector stocks, new home sales, interest rates, and other important data series. Lumber seems to be a magical predictor of where lots of things are headed... Read More

Top Advisors Corner January 20, 2016 at 10:36 AM

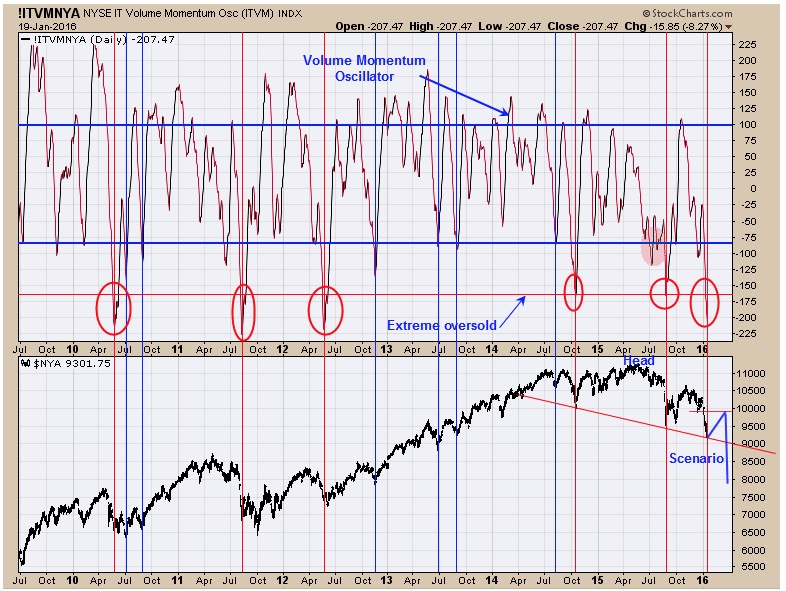

Monitoring purposes SPX: Neutral. Monitoring purposes GOLD: Sold GDX 1/19/16 at 12.45: Long GDX on 11/20/15 at 13.38. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28 As we have said before, panic is what market bottoms are made of... Read More

Top Advisors Corner January 15, 2016 at 02:06 PM

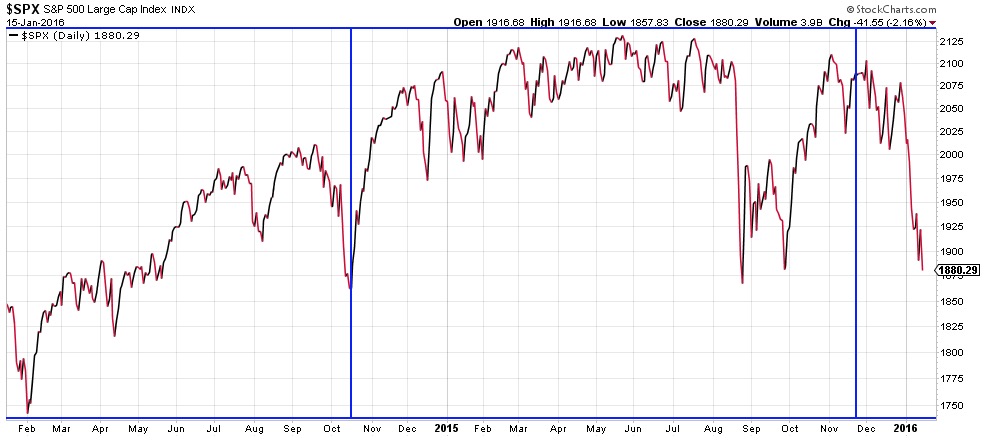

In recent letters we have correctly analyzed the box above as a high risk, high volatility area. In our most recent letters we thought (incorrectly) that a strong uptrend was developing... Read More

Top Advisors Corner January 13, 2016 at 10:30 AM

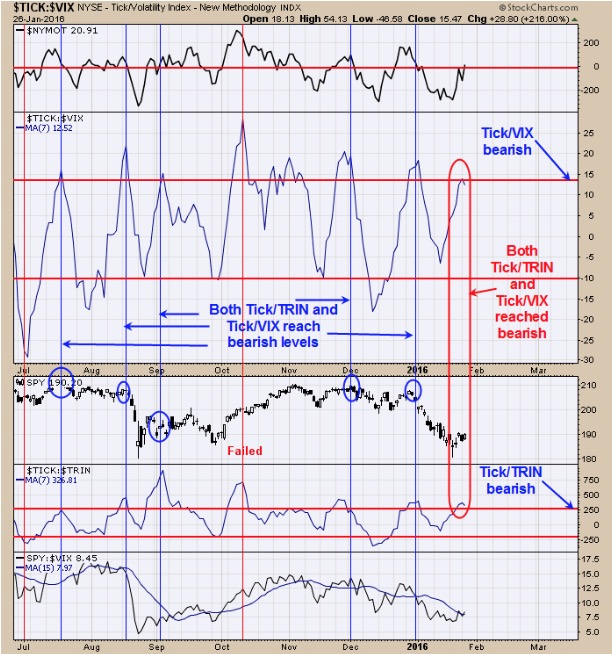

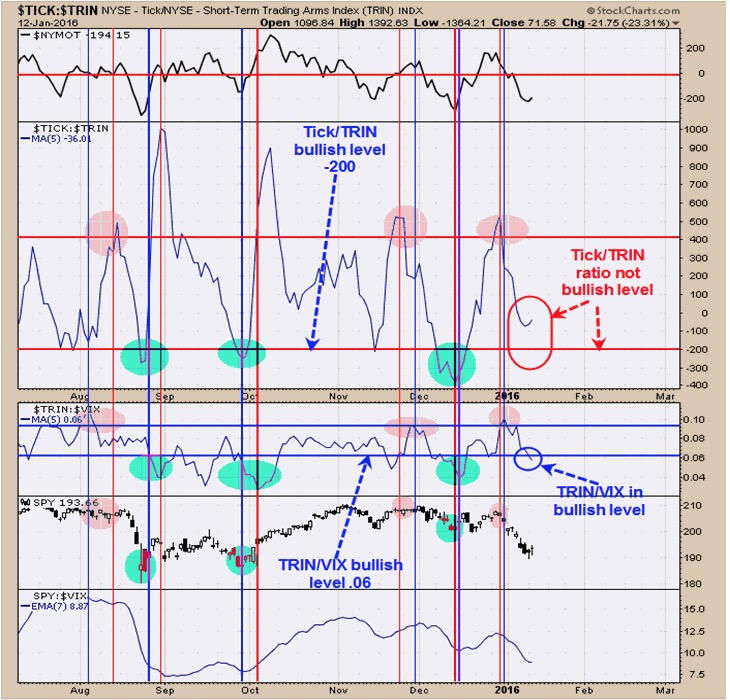

Monitoring purposes SPX: Neutral. Monitoring purposes GOLD: Long GDX on 11/20/15 at 13.38. Long Term Trend monitor purposes: Flat Panic is what makes bottoms in the market and we measure panic using the TRIN and Tick readings... Read More

Top Advisors Corner January 13, 2016 at 10:16 AM

Analyzing Downtrend Price Action During a Downtrend price does not just go down, instead it often has brief periods where it moves up... Read More

Top Advisors Corner January 11, 2016 at 02:27 PM

After 1,200 points down on the Dow over six trading days, it made sense for the market to try and rally hard for a few days. After all, the daily charts were oversold with a 30 RSI, a number from which the indices have typically blasted off during sell-offs in this bull market... Read More

Top Advisors Corner January 08, 2016 at 09:46 AM

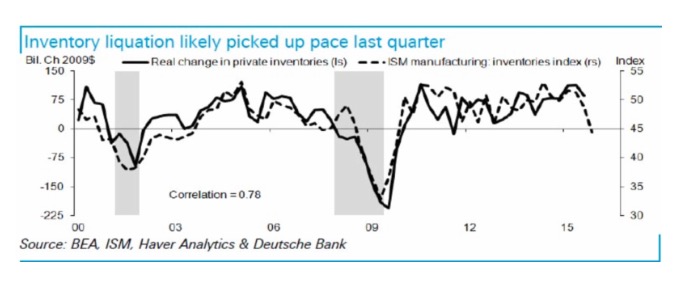

Front-loading the market - to levitate financial assets (presumably in hope for a 'rising tide to lift all boats' phenomena) is what we've assessed the Fed doing for years... Read More

Top Advisors Corner January 08, 2016 at 09:29 AM

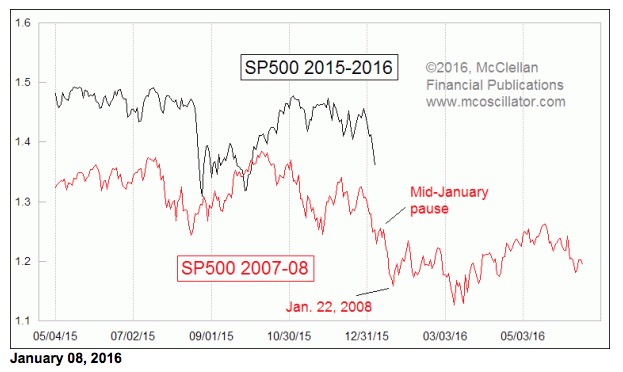

In a Dec. 11, 2015 Chart In Focus article, I posed the rhetorical question about whether the market was reliving its past from 2012, or from 2008. The financial panic in China seems to have settled the question for us, and the market has decided on the 2008 scenario... Read More

Top Advisors Corner January 07, 2016 at 10:16 AM

Monitoring purposes SPX: Closed at 2043.94 on 12/31/15; long SPX on 11/2/15 at 2104.05 Monitoring purposes GOLD: Long GDX on 11/20/15 at 13.38. Long Term Trend monitor purposes: Flat The bottom window is the 5 day TRIN and readings above 1... Read More