Top Advisors Corner July 29, 2016 at 09:10 AM

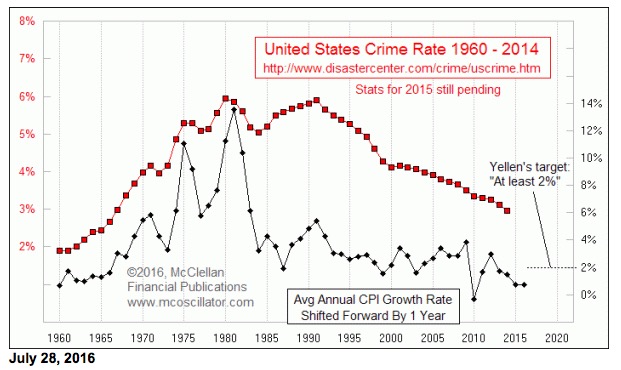

This being a campaign season, you are going to hear a lot of assertions about crime rates and the supposed solutions that various sides are proposing. So this seems like a good time to share a few bits of truth about crime data in the US, and what it is correlated to, and not... Read More

Top Advisors Corner July 29, 2016 at 08:54 AM

Monitoring purposes SPX: Short SPX on 7/26/16 at 2169.18. Monitoring purposes GOLD: Sold GDX on 6/10/16 at 25.96 = gain 14.97%. Long GDX on 5/31/16 at 22.58. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner July 25, 2016 at 09:58 AM

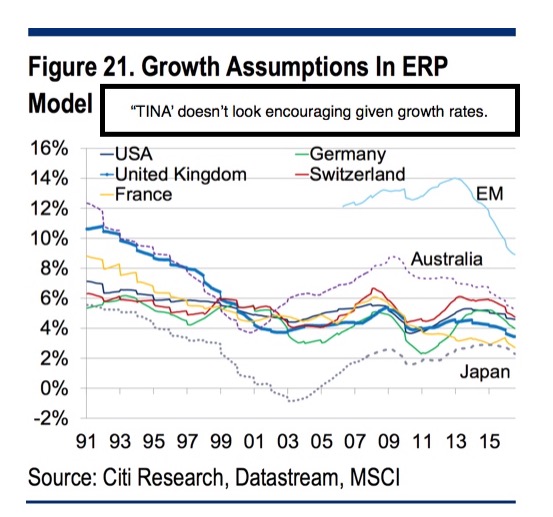

Global fragmentation - in economics, geopolitics, confidence in leadership, and a general suspicion of central bank policies in many countries... persists... Read More

Top Advisors Corner July 22, 2016 at 01:22 PM

I could honestly finish this report with the following statement. As long as we're trading above 2100-2134 on the Sp 500 the trend is clearly higher with pullbacks along the way to unwind. That's it. The truth is there for you to see... Read More

Top Advisors Corner July 22, 2016 at 10:08 AM

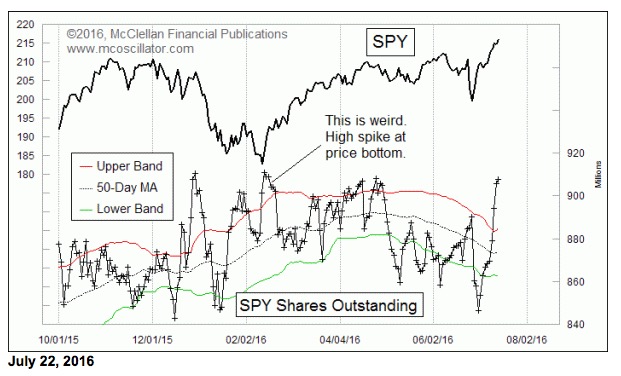

I like to watch the data on the number of shares outstanding in certain select ETFs, and one of the best for this purpose is the biggest one, SPY. It tracks the SP500, and it currently has $196 billion invested in it. So it is a big deal... Read More

Top Advisors Corner July 15, 2016 at 02:11 PM

This has been one crazy market for quite some time now. The endless overall up trend has been with us for seven plus years. The last two years have been a time for consolidation in to the teeth of some very bad news... Read More

Top Advisors Corner July 14, 2016 at 09:22 AM

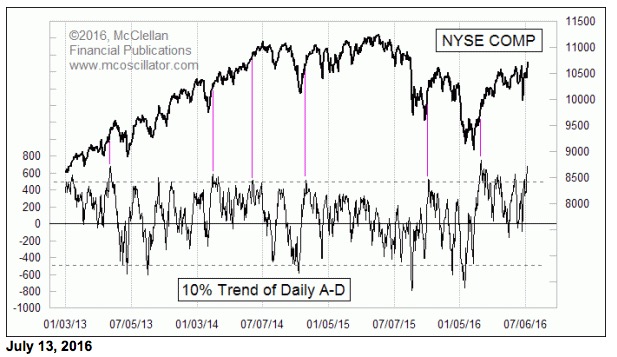

If you want to have a recipe for a sustainable bull market, the best ingredient to start with is “gobs of breadth”. Strong A-D data is a sign of plentiful liquidity... Read More

Top Advisors Corner July 14, 2016 at 09:12 AM

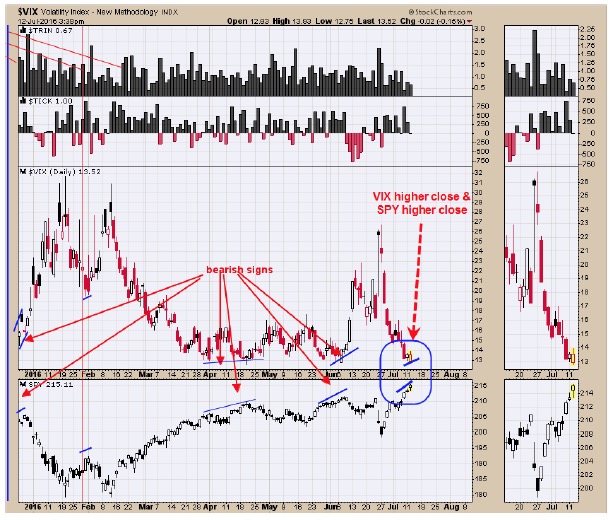

Monitoring purposes SPX: Sold SPX on 7/1/16 at 2102.95=gain 5.12%; Long SPX on 6/27/16 at 2000.54. Monitoring purposes GOLD: Sold GDX on 6/10/16 at 25.96 = gain 14.97%. Long GDX on 5/31/16 at 22.58. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner July 08, 2016 at 06:45 PM

We have been going nowhere for a couple of years. Within that process the emotions of all traders were tested over and over. Many times it appeared that the market was about to break down... Read More

Top Advisors Corner July 08, 2016 at 06:45 PM

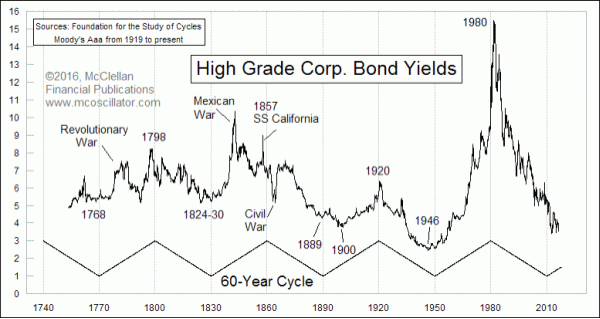

The 60-year cycle in interest rates has been operating for as long as interest rate data have reliably been collected. And right now it is saying that we should be in an upward trend for interest rates, lasting until 2040... Read More

Top Advisors Corner July 07, 2016 at 12:17 PM

Monitoring purposes SPX: Sold SPX on 7/1/16 at 2102.95=gain 5.12%; Long SPX on 6/27/16 at 2000.54. Monitoring purposes GOLD: Sold GDX on 6/10/16 at 25.96 = gain 14.97%. Long GDX on 5/31/16 at 22.58. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner July 01, 2016 at 01:46 PM

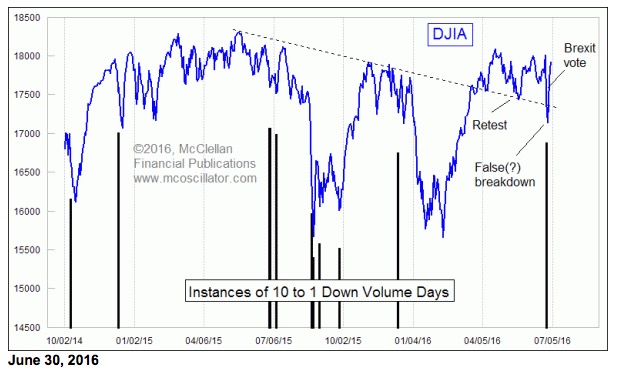

The market spent days wondering what would happen with Brexit. Would Britain leave or stay was the big question. A surprise vote of leave had the global markets heading south is a very big way... Read More

Top Advisors Corner July 01, 2016 at 09:44 AM

The panic over the surprise outcome in the British referendum over leaving the European Union brought about a fairly rare market event: a 10-1 down volume day... Read More