Wow,

What a quarter for value decimation. Many technicians are overlaying the 2008 decline with the current decline and measuring our progress as we fall into oblivion. Even Cramerica was bearish this morning. The commentators and guests were all frumpy this morning after measuring the 3rd quarter. It didn't help when a large diversified industrial like Ingersoll Rand was pessimistic and lowered expectations.

I ran some scans to see what might be outperforming the overall markets and if any sectors are starting to turn up.

Obviously the pipelines and REITS are moving higher or currently holding up. The grocers and Saputo are turning up. The grocers did pretty well in the downturn last time so this might be a safe entry.

I found a few other gems in this 'rocky' market. The rule that 80% of the stocks follow the indexes is true. But finding the ones that can fight the down trend can be interesting and profitable. They should have some underlying trend that investors keep holding onto.

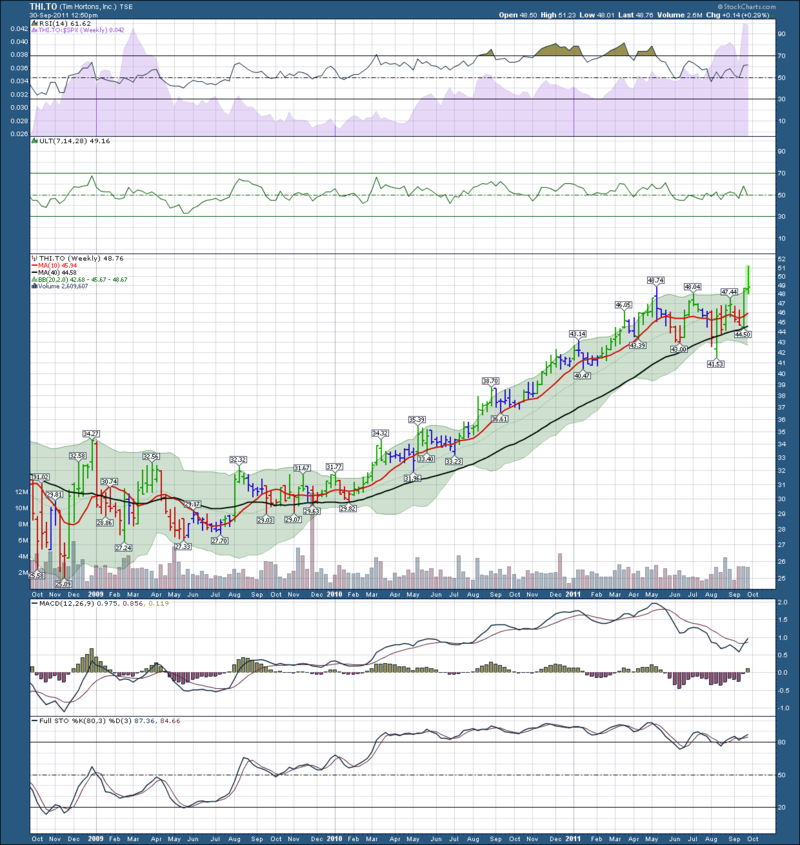

Well, if we are heading into recession, and winter, and hockey rinks, and short daylight hours, we are probably heading to: TIm Hortons.

It made new highs this week.

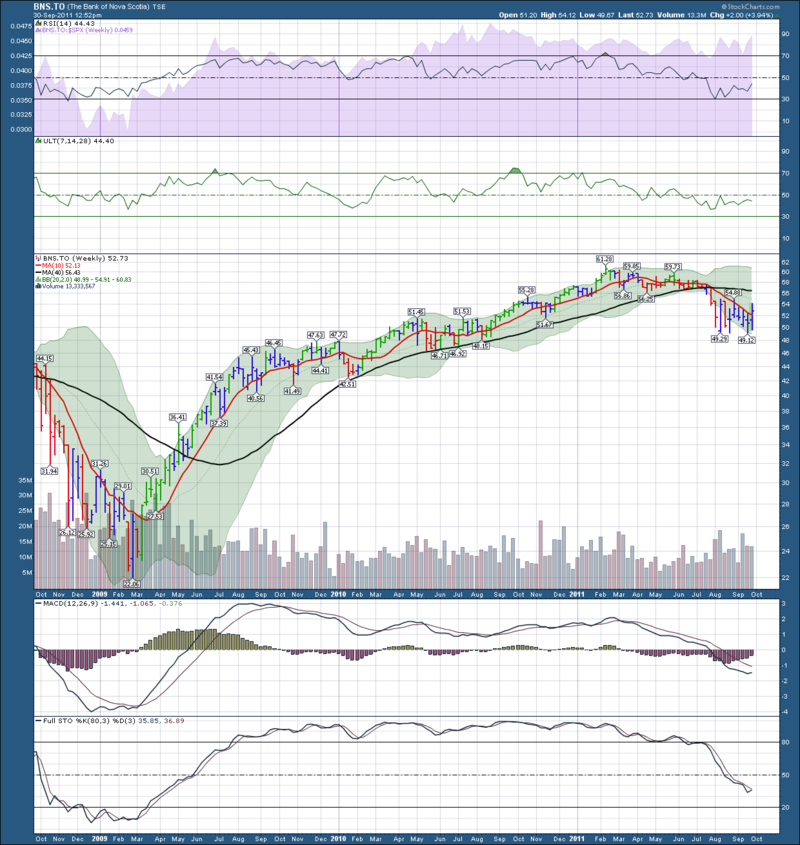

The banks aren't looking great but Bank of Nova Scotia has some serious support. Without doing any serious analysis on latin America's markets, this would be a risky entry. However, It broke back above it's 50 DMA this week.

Check out Trilogy. This stock is really holding up well. However, looking on the right side, this looks like a move down is starting this week.

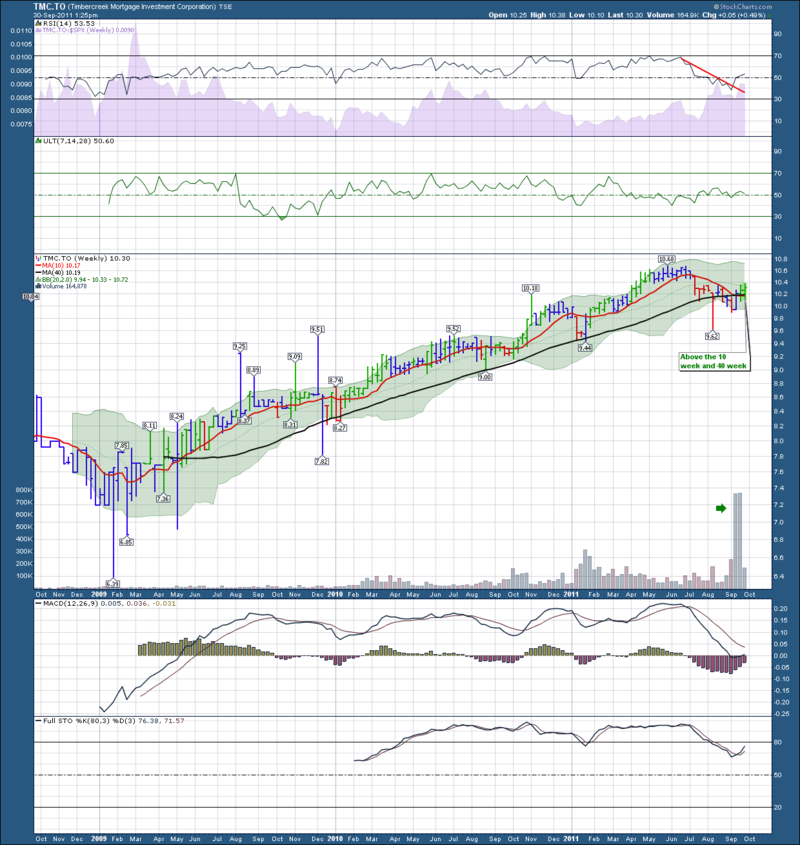

This business environment does not appear to be a problem in Timbercreek. Check out the volume profile on the right edge of the chart.

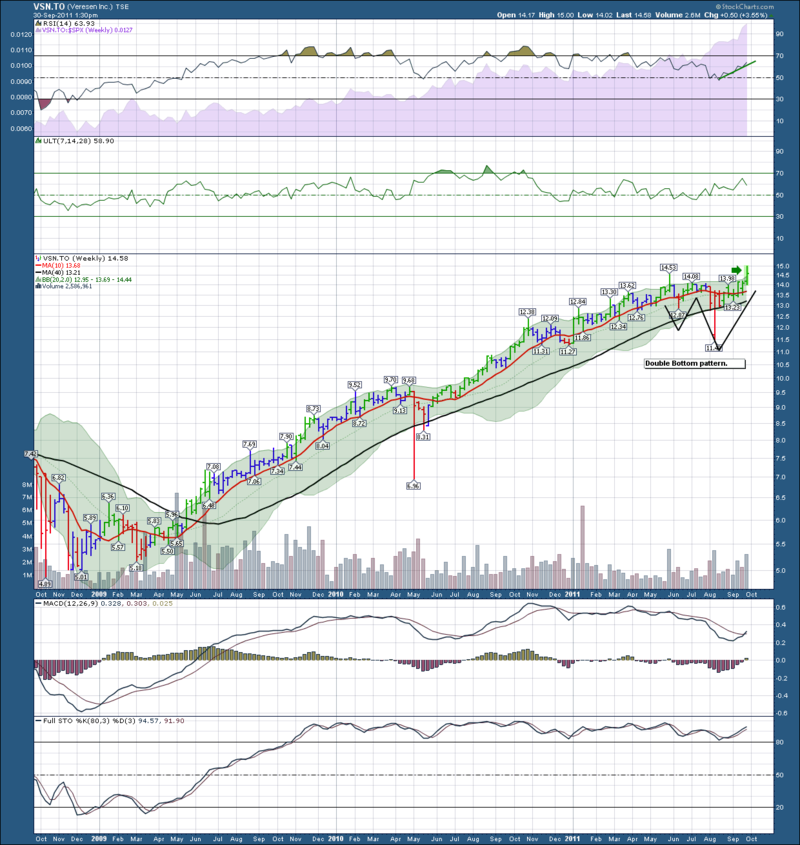

This Veresen chart made new highs this week.

Not all stocks are going down. But even a Tourmaline (TOU.TO) lost some support this week.

There are some incredible stocks at incredible prices. Imagine if the above stocks had a bull market pushing them higher instead of fighting the trend of the indexes. Normally strong stocks give the strongest surge out of the shoot when a market has a reversal and goes higher. It can be even better when the entire industry group turns higher.

It's been the first full week of the blog. Hopefully you are enjoying it and it is providing good information for you to help your trading. If you like the blog, you can add it to your inbox or an RSS feed up in the top right of this page. You can also double click on the pictures to expand them.

Good trading,

Greg Schnell, CMT