The recent S&P rally to new reactionary highs has shown to be on rather slim-footing given that volume patterns are rather tepid. We don't disagree in the least, but the fact of the matter is that the advance/decline figures have been rather "good" of late and showing impressive strength in the face of this volume contraction. We've always been led to believe that volume equals conviction, but the current rally has only convinced in terms of points and percentages...not in volume.

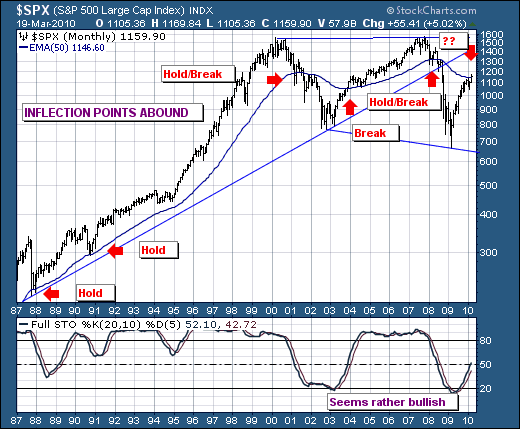

So we must question whether the S&P is on sound-footing or not? Our initial reaction would be "no"; but when we look at the longer-term monthly S&P chart, we can't dismiss the fact that the S&P has broken out above its 50-month exponential moving average by a slim 1% to 2% margin. In the past, the 50-month has been an inflection point that gives confidence as to the next market move - be it higher or lower. The current breakout coupled with the still rising full stochastic means we lean "long" at this point. This is a very difficult statement to make given we've fought the rally as being of the counter-trend variety.

Still, the potential exists for this nascent breakout to fail, and for prices to falter and extend below the 1146 level once again. This would lead to a resumption of the bearish trend. However, if prices extend from current levels - then we won't be surprised to see a test of the 1400 to 1500 highs in the next several years. Yes, we hear the knashing and wailing and we can point to a litany of economic issues that illustrates the markets should move lower; and they very well may do so. But the technical breakout stands for now; not on firm footing - but a footing that must be respected.