Well, a few months pass and the price of oil has nearly doubled. Is it all blues skies from here on in?

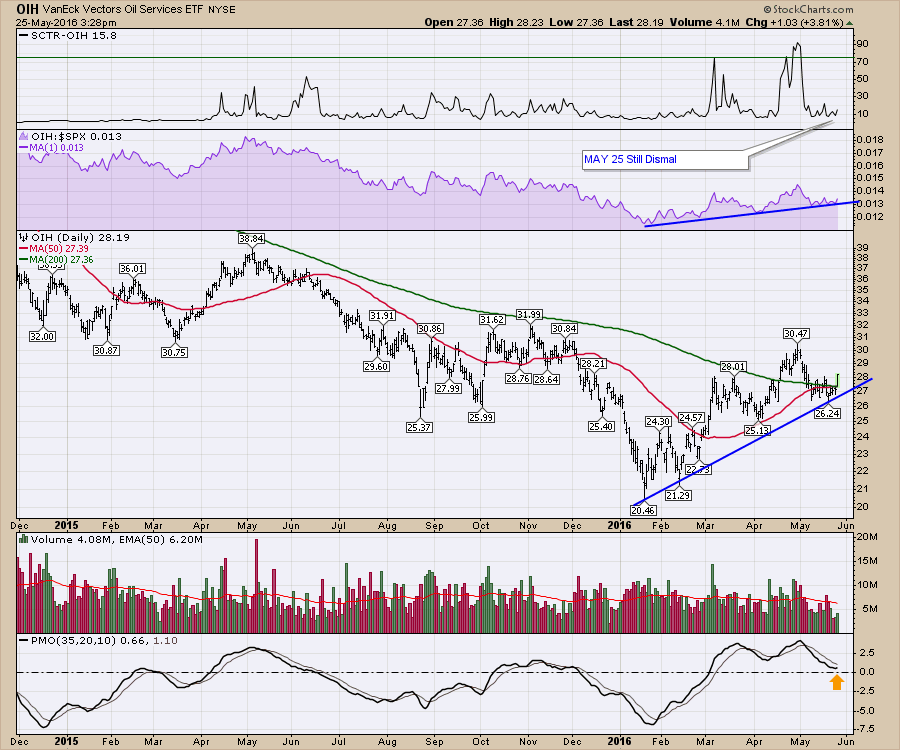

The oilfield service ETF (OIH) is shooting up nicely today. The SCTR still shows a terrible reading, but there is little doubt that the sector seems resilient to pullbacks and wants to go higher. If the PMO turns higher to cross the signal line here, that would create a very bullish signal with a positive cross while above zero.

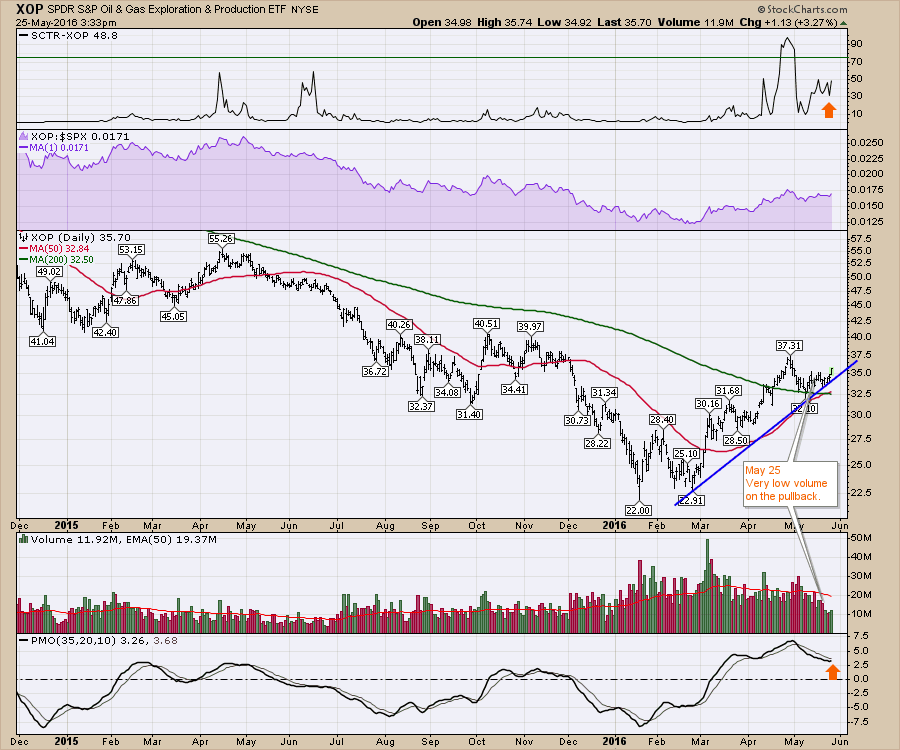

The exploration and production companies are doing well. The XOP ETF represents that group. The SCTR is only around 50 so that is not great. The Relative Strength in purple has higher lows for the last three months and is very close to making new 6-month highs. The $40 level looks to be significant resistance but we will battle that when we get there. Currently, there is a $4-$5 move available. With the low volume of selling on the pullback, the buyers might have to pay up to buy into the group.

We have the refiners ETF (CRAK) that holds a barrel full of refining companies. As the price of oil holds up, this squeezes the margins of refiners. As the ETF is only 9 months old, there is not a lot of history here. However, we can see that so far, it is just cycling within the initial range established in the first few months.

We have the refiners ETF (CRAK) that holds a barrel full of refining companies. As the price of oil holds up, this squeezes the margins of refiners. As the ETF is only 9 months old, there is not a lot of history here. However, we can see that so far, it is just cycling within the initial range established in the first few months.

I particularly like the chart of Crude Oil ($WTIC) today, cracking through $50 per barrel. Wednesday's price bar will show up after the market close. This will put the SPURS in purple near 11-month highs.

I particularly like the chart of Crude Oil ($WTIC) today, cracking through $50 per barrel. Wednesday's price bar will show up after the market close. This will put the SPURS in purple near 11-month highs.

If you would like to hear more about the oil related trades, I focus time on the oil industry during the Commodities Countdown Webinars and there is usually one on Thursdays at 5 EDT. Click here to register for The Commodities Countdown Webinar 2016-05-26. This week, there seems to be a lot of heat lining up in the commodities. I look forward to having you join me live or catch the archives by following this link after the webinar. StockCharts.com Webinar Archives.

Recently, I posted some articles discussing the gold industry and during the last couple of Commodity Countdown Webinars (2016-05-19 and 2016-05-12), we have been more cautious on the group. Here is a recent article about the Gold Miners on the Commodities Countdown blog. The Gold Miner's Ratio Breaks. You can also click on the bottom of the blog chain to get those emails as well.

As an aside, Chip announced more details about Chartcon 2016 on the recent ChartWatchers newsletter. There is a window of opportunity to have 10 people - just 10 people - join all the StockCharts technicians in California. I mentioned I would like to play some golf. So there are a few golf spots (3) available to swing the sticks with me and socialize on the golf course. I'd thoroughly enjoy that. Can you make it to California? Here are the details. See Chips Point #4.

Good trading,

Greg Schnell, CMT, MFTA.

PS. Don't forget to register for the Commodities Webinar!