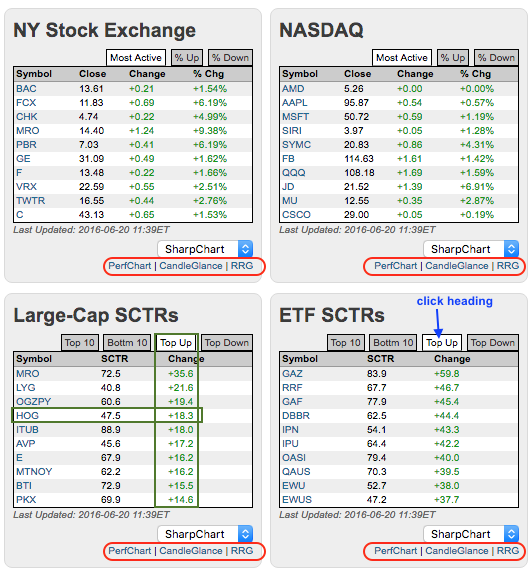

Chartists looking for the movers and shakers of the day need look no further than the StockCharts home page. Tables for most actives and SCTRs can be found midway down on the left-hand side. These tables can be viewed by Top 10, Bottom 10, Top Up and Top Down (click column headings). I like to sort the large-cap SCTRs by Top Up to find stocks showing a burst of relative strength. Notice that there are links under each table to create PerfCharts, CandleGlance Charts or Relative Rotation Graphs (RRG) for the ten symbols.

I spotted Harley Davidson (HOG) after looking at CandleGlance charts for the large-cap stocks with the biggest gains in their SCTR. On the price chart, HOG broke the wedge trend line and 200-day SMA with a gap and big surge today. Notice that the stock reversed in the 50-61.8% retracement zone. The retracement amount and falling wedge are typical for corrections after a sharp advance. Today's breakout signals an end to this correction and a resumption of the February-March advance. A strong breakout should hold so chartists should watch today's gap. A close below 45 would fill the gap and call for a reassessment.

****************************************

****************************************

Thanks for tuning in and have a great day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************