On the Relative Rotation Graph for US sectors (XLY), the Consumer Discretionary sector started to curl up and move higher while inside the lagging quadrant. After a weak performance against SPY for months, XLY started to improve on the JdK RS-Momentum scale a few weeks ago and, very recently, also started to gain (albeit minimal, for now) on the JdK RS-Ratio scale.

This sort of rotation is enough reason to dive into the sector members and see if we can find any potential new leaders. That way, we are prepared when the sector-rotation indeed follows the expected path.

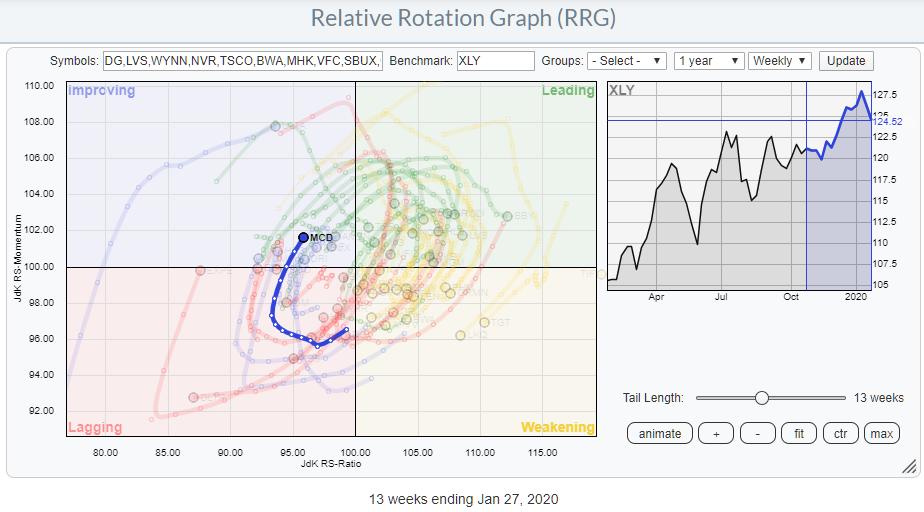

Weekly RRG showing XLY members vs. XLY, highlighting MCD

Weekly RRG showing XLY members vs. XLY, highlighting MCD

The RRG above shows the rotation for members of XLY, against XLY as the benchmark, with the tail of MCD highlighted. This rotation shows an improvement on both scales following a weak period, with MCD now inside the improving quadrant and traveling at a positive RRG-Heading. Assuming a continuation of this trend/rotation, MCD could become, once again, a leader in the Discretionary space.

Of course, the final check remains (as always) the price chart, as printed above.

Here, we see a stock that is still well in its uptrend that started to accelerate in 2015. It has not always been an outperforming sector; on the contrary, as a matter of fact. Looking at the RS-Line, we see a primarily sideways move since 2016, with the red horizontal line being a level of interest as it provided both support and resistance a few times since.

Most recently, that horizontal level caught the decline in relative strength off the mid-2019 high; a nice low has since formed against it. At the same time, price found support at its rising support line, which has been in play since late 2016.

Given the current strength in MCD, during a period of increasing volatility and shaky conditions for the S&P 500, this could be one of the new leaders inside the Consumer Discretionary sector.

-- Julius

My regular blog is the RRG Chartsblog. If you would like to receive a notification when a new article is published there, simply "Subscribe" with your email address.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Want to stay up to date with the latest market insights from Julius?

– Follow @RRGResearch on Twitter

– Like RRG Research on Facebook

– Follow RRG Research on LinkedIn

– Subscribe to the RRG Charts blog on StockCharts

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I cannot promise to respond to each and every message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Host of: Sector Spotlight

Please find my handles for social media channels under the Bio below.

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I cannot promise to respond to each and every message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.