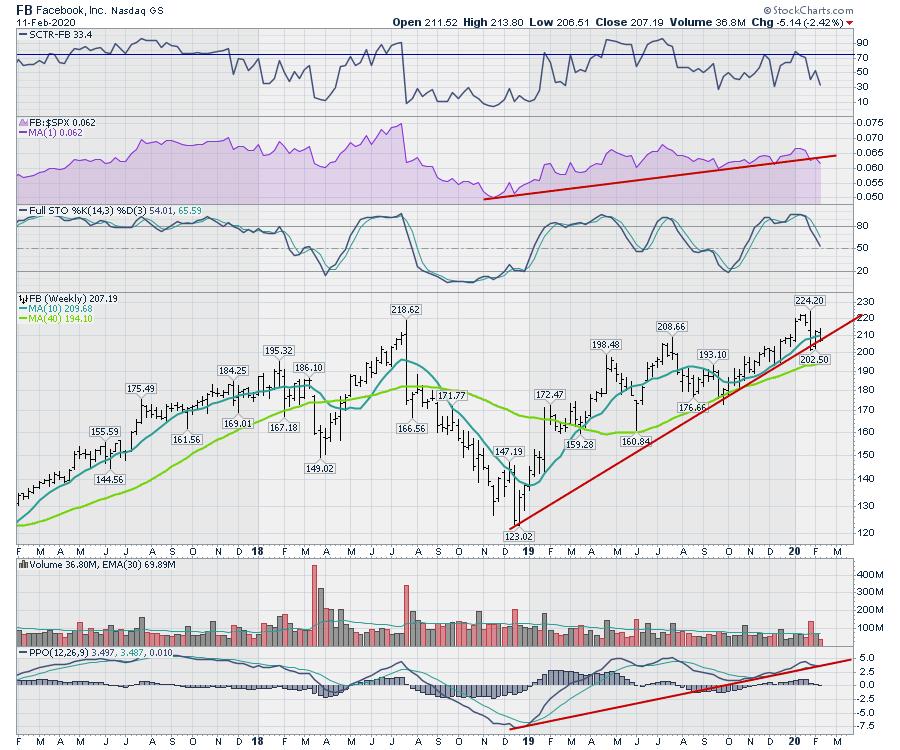

Facebook (FB) has been moving in a wide range for the last few years. Once a leading stock, it now resembles a 2nd-place performer as all the large-cap Tech teammates continue to run to new highs. With the SCTR ranking in the second lowest quartile as the markets bang up new high after new high, it seems Facebook is becoming more "unliked" since the SCTR peak in May.

After the brief super-surge to new highs in price to start the year, it has definitely underperformed the pear group. The stock has now topped out in the 220s in 2020. That blast was an unsuccessful second run to hold new highs just above the former highs from 2 years ago.

The relative strength (in purple) has broken the uptrend as well, which suggests to me this stock needs to get some mojo soon - or else it could start a second round of selling, like we saw in the second half of 2018 from similar levels.

During this second month of 2020, Facebook is trying to hold the 18-month uptrend on both the price chart and the PPO momentum indicator. This would appear to be a good place for bulls to second-guess their positive strategy in case it doesn't work out and Facebook starts to shed value.

Stay tuned to see if this is a sequel to 2018.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com