Don't Ignore This Chart! September 30, 2020 at 11:03 AM

Leading stocks in leading industry groups. If you've struggled with your investments, read that line over and over again. Investing in leaders will change your returns and likely alter your opinion about your chances to outperform the overall market... Read More

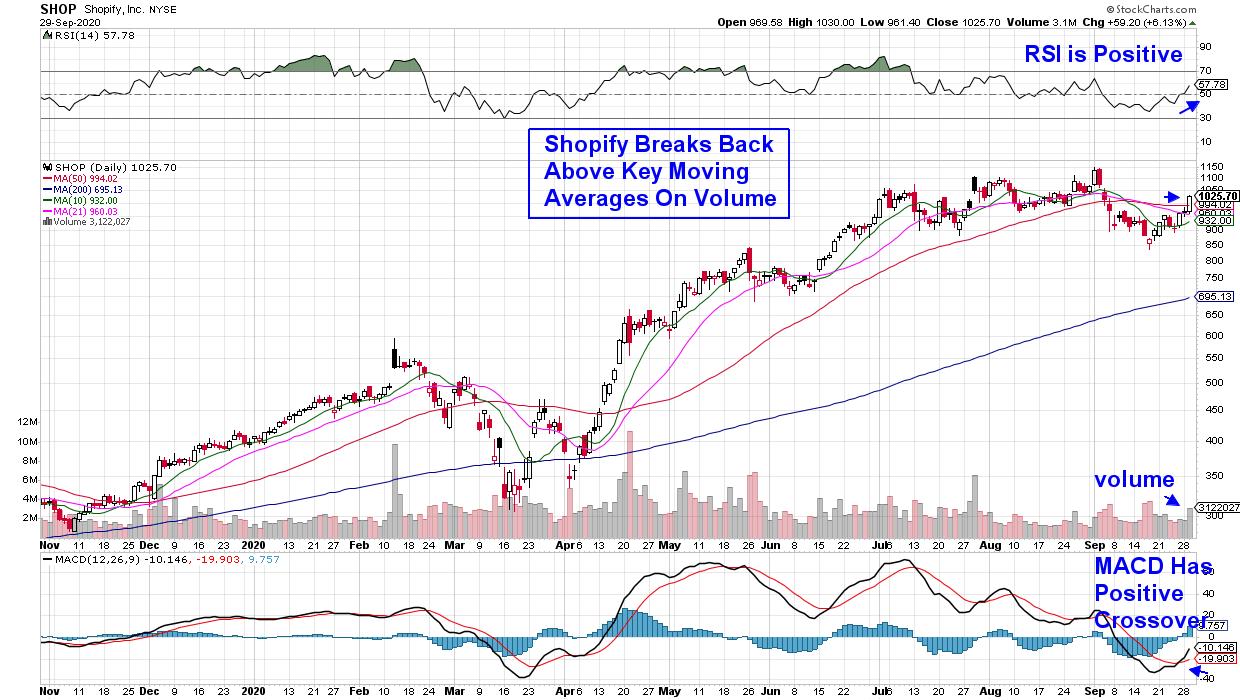

Don't Ignore This Chart! September 29, 2020 at 09:22 PM

The Nasdaq Composite broke back above its key 50-day moving average on Monday and after today's action, the RSI and MACD are now in positive positions... Read More

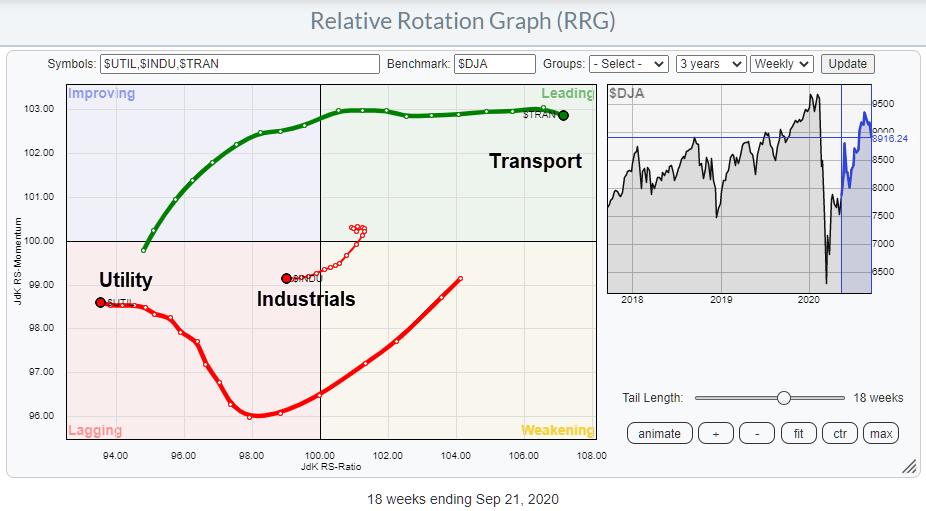

Don't Ignore This Chart! September 24, 2020 at 04:50 PM

The S&P 500 and the Nasdaq 100 are probably the most discussed charts/indexes. The Dow Jones Industrials is probably the most well known index. From an RRG point of view, the breakdown of the S&P 500 into its sectors is probably the most-watched RRG... Read More

Don't Ignore This Chart! September 23, 2020 at 11:59 AM

Short squeezes can result in explosive upside moves. We saw it at the end of 2019 with Tesla (TSLA). Once the stock broke 400, it absolutely flew to the upside... Read More

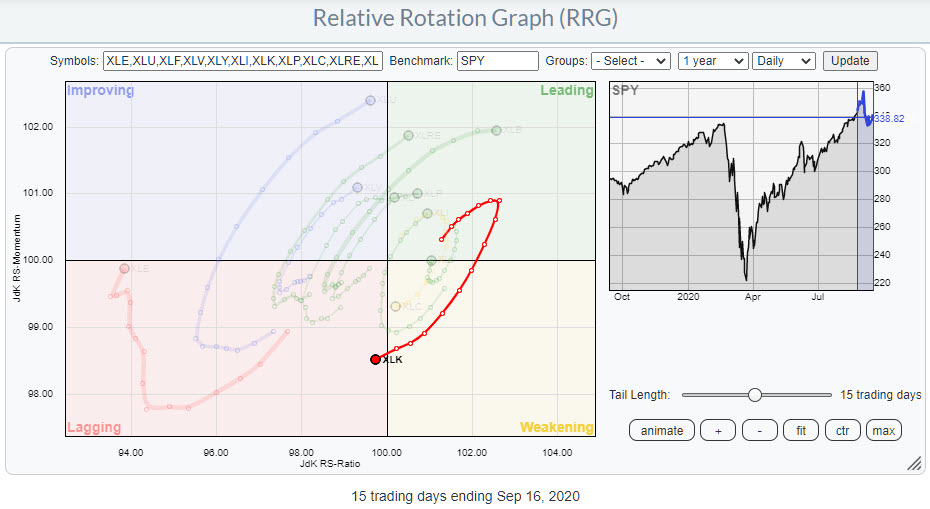

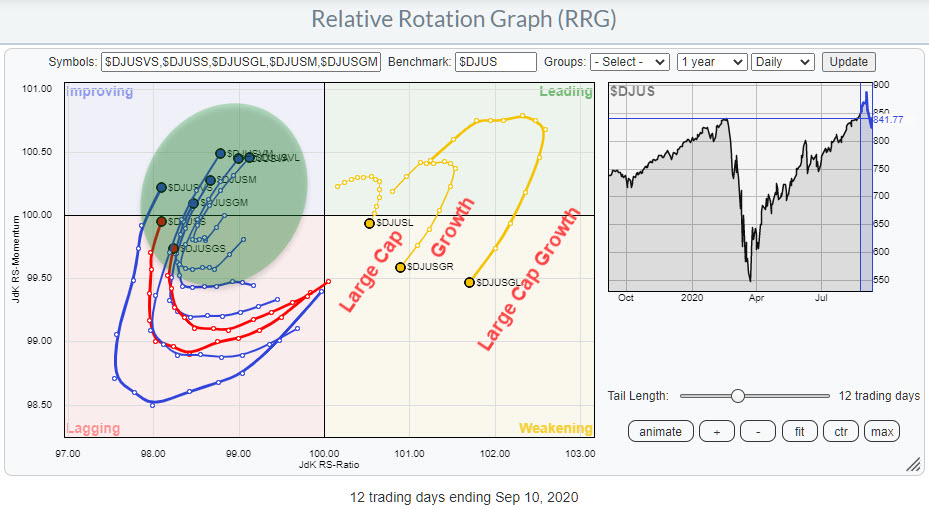

Don't Ignore This Chart! September 17, 2020 at 06:36 AM

At yesterday's close XLK, the technology sector, rotated into the lagging quadrant. This happened a few times since the market started to rally out of the March low. On the daily chart to be exact... Read More

Don't Ignore This Chart! September 12, 2020 at 09:09 AM

I follow a very simple ratio every day, which is the iShares Russell 1000 Growth ETF vs. the iShares Russell 1000 Value ETF (IWF:IWD)... Read More

Don't Ignore This Chart! September 10, 2020 at 03:02 PM

Last week's selloff primarily hit some mega-cap names in Technology, Communication Services and Discretionary stocks. For sure, it shook up markets pretty well and, as usual, the selling of risk assets led to an inflow into risk-off assets like bonds and more defensive sectors... Read More

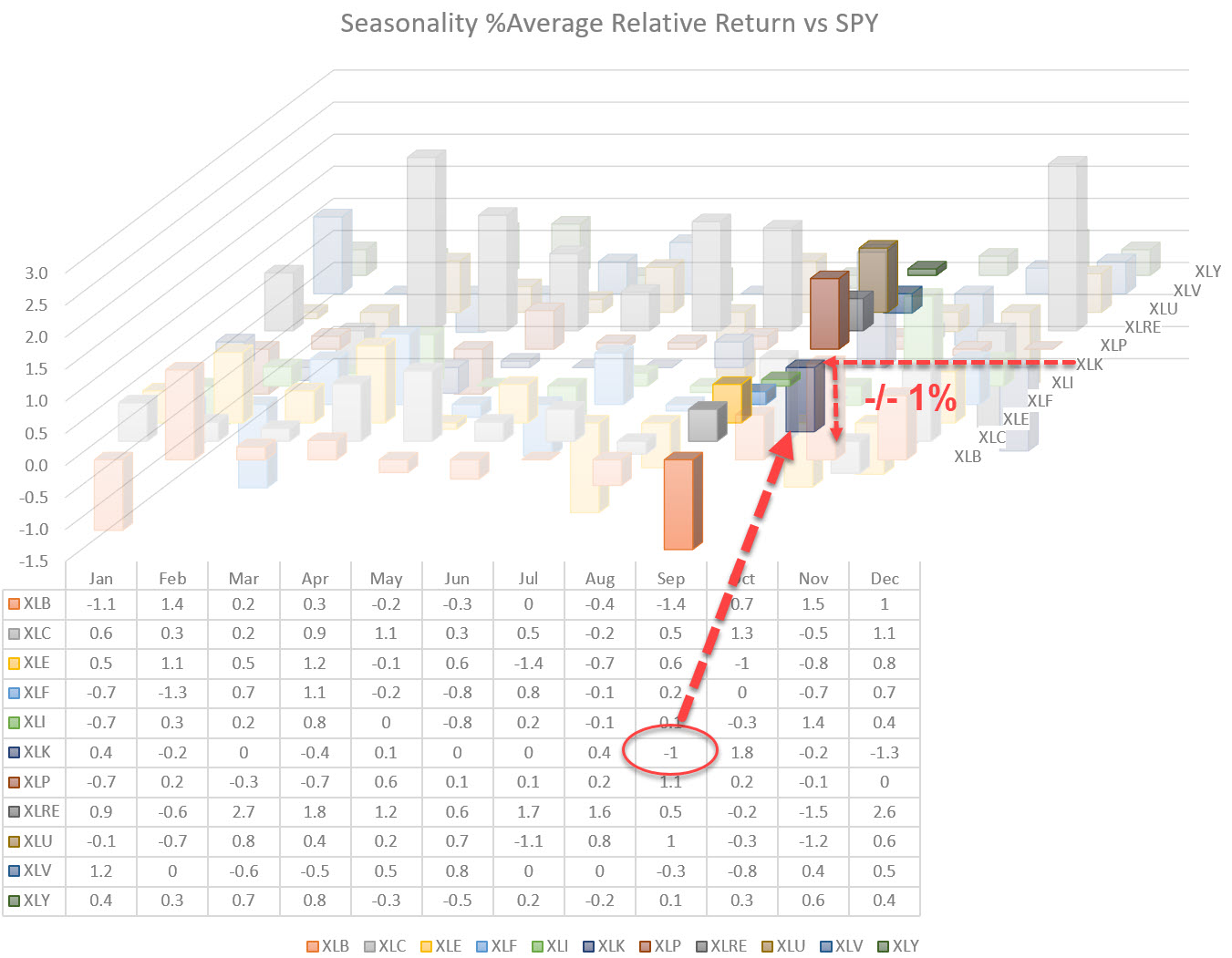

Don't Ignore This Chart! September 03, 2020 at 12:20 PM

Last Tuesday in Sector Spotlight, as well as in my last article of the RRG blog, I discussed seasonality for US sectors. While going over the table showing the average returns per sector per month, my eye fell on another number..... Read More