We combine fundamentals and technicals at EarningsBeats.com to deliver market-beating returns. While past results can never guarantee future results, our strategy has a documented record of crushing the S&P 500, not just beating it. Our approach is undeniably simple: find companies that are (1) underpromising and overdelivering, and (2) under tremendous accumulation. That's it.

The first part of this strategy is just doing our homework. We review thousands of earnings reports each quarter and organize those that beat Wall Street estimates in a nice, neat, tidy Strong Earnings ChartList. They do need to be liquid (trade at least 200,000 shares daily on average) and show bullish technical characteristics (typically solid relative strength). We package that in a StockCharts.com ChartList and make it available for download to our EarningsBeats.com members. The homework is now done.

From there, we can run scans to find great trading candidates from this ChartList. One software stock that just reported its latest quarterly results absolutely crushed Wall Street estimates. They also raised their guidance and Wall Street has taken notice. In fact, I'll go so far as to say MongoDB, Inc. (MDB) should be taken seriously as a MAJOR player in software for 2021. I believe the recent surge is the start of something much, much bigger:

Nearly everyone looking at this chart will have the same first impression. "I've missed the boat. It's already gone. It can't go any higher." Hopefully, as you reflect on many of the recent winners in this continuing secular bull market advance, you realize that repricing a company based on new and improving earnings growth is a process that takes a much longer period than a week.

Could MDB pull back in the near-term? Absolutely. Will it? I don't know. We value momentum at EarningsBeats.com and we want to be a part of it. Our portfolios comprise companies showing relative strength. We don't argue over price. In fact, our quarterly "draft", where we select 10 equal-weighted stocks for each of our 4 portfolios, occurs the 19th calendar day of February, May, August, and November. The timing is such that most companies have recently (within the past 3-4 weeks) reported their earnings results. We can review industry strength and individual stock strength within those industries and select our favorite 10 stocks for each portfolio. We "buy" at that price. We don't try to catch a stock on a pullback, although many of our members do. If our draft were to occur today, I'd be hard-pressed to pick a software stock over MDB.

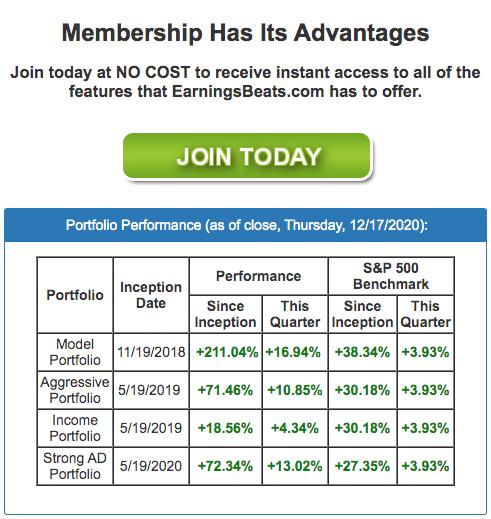

While our selection process might appear to be "chasing" to some, our results suggest otherwise. Here are our inception-to-date returns that we publish on our website every day:

Our Model Portfolio, which is now in its 9th quarter, has beaten the S&P 500 in 7 of the last 8 quarters and has beaten the S&P 500 by more than 10 percentage points in 5 of those 7 quarters! It's up 211% in 2 years and 1 month. That's more than tripling your money in a little more than 2 years. And it's done so by diversifying into 10 different stocks in 10 different industry groups - all equal-weighted. During the first month of this latest quarter (November 19th - December 18th), our Model Portfolio is up 16.94%, already 13 percentage points higher than the S&P 500. Quite honestly, I never expected this type of performance from our strategy, but it's clearly been, and continues to be, a winning strategy.

If you'd like to join the thousands of investors/traders in our community, CLICK HERE to subscribe to our FREE EB Digest newsletter, published 3x per week, or our paid service.

Happy trading!

Tom