When I brought up the Relative Rotation Graph showing the NYFANG components against $SPX, I made a few interesting observations.

In general, the rotation of almost all tails looks horrible. They are either already inside the lagging quadrant (and) at a negative RRG-Heading, or rotating back to lagging. The two exceptions are TSLA, which is inside improving and at a strong heading, and TSLA, which is inside lagging, but also at a strong heading.

However, when I inspect both of their price charts, I still see a lot of risks. The tails on BABA and BIDU are now strongly rotating back down to the lagging quadrant, which completely confirms their weak price charts.

The tail that I want to focus on for this article is GOOGL (Alphabet).

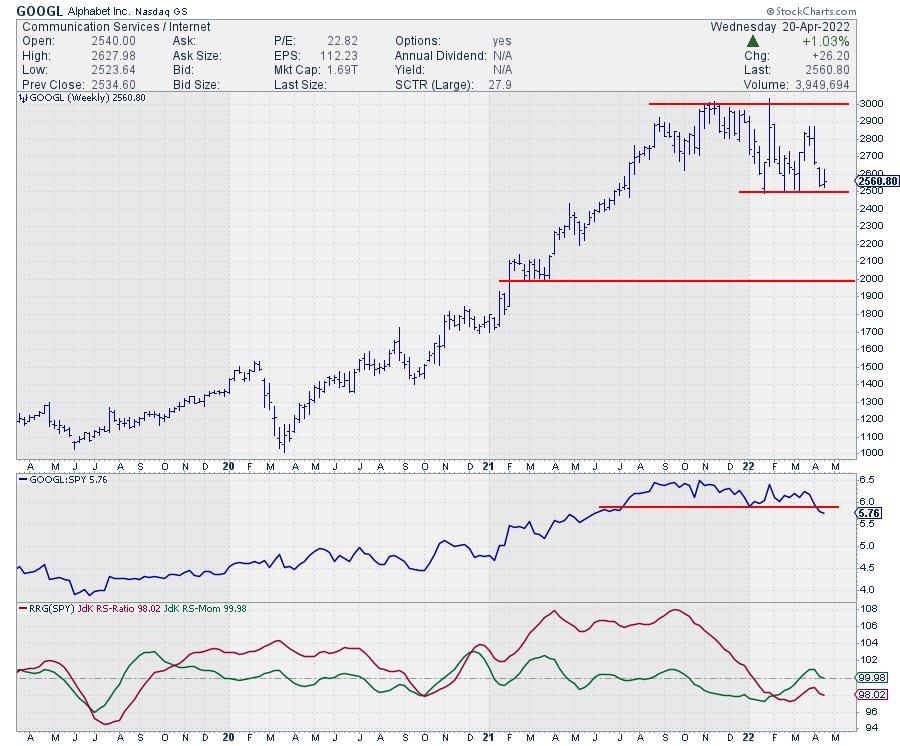

As you can see on the blown-up RRG, GOOGL made a sharp hook back down to lagging after briefly traveling through improving. Usually, that is not a good sign. And when I look at the price chart, I think this time is no different.

Since the start of this year, GOOGL already tested support near 2500 three times already and is close to a fourth. Relative strength has just broken its floor and is likely to accelerate lower.

Breaking that 2500 support level on the weekly chart (meaning we need to see a Friday close well below 2500) will be a significant deterioration for this chart and likely cause an acceleration lower in price as well. Based on the height of the pattern (range between 2500-3000), a target price can be pegged around 2000.

My regular blog is the RRG Charts blog. If you would like to receive a notification when a new article is published there, "Subscribe" with your email address.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Host of: Sector Spotlight

Please find my handles for social media channels under the Bio below.

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I cannot promise to respond to each and every message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.